With tax deadlines delayed this year, cyber criminals have used the extra time to send even more tax-related scams, recently targeting people with .edu email addresses. Be on the lookout for this active phishing email.

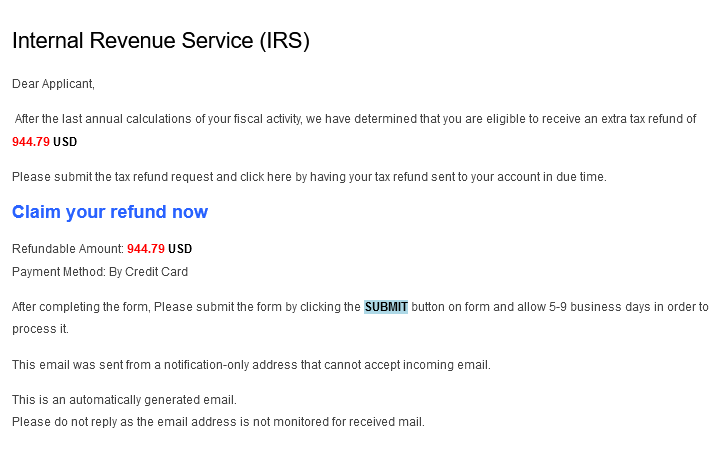

The emails display the IRS logo and use various subject lines such as "Tax Refund Payment" or "Recalculation of your tax refund payment." They ask people to click a link and submit a form to claim their refund. When people click on the link, it takes them to a website that asks them to provide personal information such as Social Security number, date of birth, driver's license number, electronic filing PIN, and more.

What to do: Do not give out any information. Forward scam emails to the IRS at phishing@irs.gov. Do not respond to these emails, or click on links and attachments.

Remember, the IRS will never:

- Initiate contact with taxpayers by email to request personal or financial information.

- Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card, or wire transfer. Generally, the IRS will first mail a bill to any taxpayer who owes taxes.

- Threaten to immediately have a delinquent taxpayer arrested.

- Demand payment without the opportunity to question or appeal.

- Ask for credit or debit card numbers over the phone.

Resources

- IRS warns university students and staff of impersonation email scam (irs.gov)

- Where's My Refund? (irs.gov)

- Taxpayer Guide to Identity Theft (irs.gov)

- W-2 Phishing Scam Targeting 2021 Tax Season (bleepingcomputer.com)

Sample Phishing Email