Billing

The Office of Student Services sends all bills electronically to the student's Boston College email address. No paper bills are mailed to the student's home address. Students will be notified at their Boston College email address whenever an online bill is generated.

If students prefer to use another email account, they will need to forward their Boston College email account using Gmail's forwarding service.

Billing Schedule

The schedules below indicate when charges will first appear on the student's billing statement. Updated billing statements are emailed monthly. Between statements, students can view all recent transactions by selecting “Recent Activity” in “My Bill”—this view has the most up-to-date student account information.

Note: Charges appearing on the student's bill may be dependent on whether he or she has registered for courses.

Undergraduate and Law School Students

- Summer charges: May

- Fall charges: mid-June

- Spring charges: mid-November

Graduate and Woods College Students

- Summer charges: May

- Fall charges: mid-July

- Spring charges: mid-December

Billing Deadlines

The standard due dates for bills are listed below. Should any of these dates occur on a weekend or holiday, bills will be due the previous business day.

Payments received after the statement due date are subject to a $150 late payment fee.

Undergraduate and Law School Students

- Fall semester bills are due on August 8

- Spring semester bills are due on December 9

Graduate and Woods College Students

- Fall semester bills are due on September 5

- Spring semester bills are due on January 16

View Your Bill

Students must log into their Agora Portal account and select "My Bill." My Bill is Boston College’s electronic student account billing and payment system. Once accessed, students can view and pay their student account bill online. Students can also print a copy of their bill and view previous invoices.

Note: Access to My Bill requires two-step verification. Two-step verification is utilized to further protect your student account in the event your password ever becomes compromised. Students can set up two-step verification by visiting www.bc.edu/2step. Students who do not set up two-step verification in advance will be prompted to do so upon accessing My Bill in Agora Portal.

Two-step verification does not apply to authorized payers on the student's account. For more information about two-step verification at Boston College, visit the 2-Step Verification page.

Third-party payers are parents, guardians, or sponsors who can view student account bills and make payments through My Bill. My Bill is Boston College’s electronic student account billing and payment system. To authorize third-party payers, students must select the "My Bill" link in their Agora Portal account and select "Authorize Payers" from the menu bar. Once authorized, third-party payers can view and pay bills at www.bc.edu/mybillparent.

Guests can make a tuition payment or add money to a student’s Dining account without having to log into My Bill. My Bill is Boston College’s electronic student account billing and payment system.

Make a Payment

A 529 Plan is an education savings plan operated by a state or educational institution designed to help families set aside funds for future college costs. If you are paying your tuition with this type of plan, please have the check made payable to Boston College sent to the following address:

Boston College Student Services

140 Commonwealth Avenue

Lyons Hall Room 103

Chestnut Hill, MA 02467-0123

Please schedule your payments to ensure delivery by the bill due date of August 9, 2025 for Undergraduate and Law students, and September 6, 2025 for all others. Please ensure that the student’s name and Eagle Number are clearly referenced on all payments.

All checks and money orders (do not send cash) should be made payable to "Boston College" and drawn on a U.S. bank in U.S. dollars. Payments that are Express Mailed must be sent to the address below for correspondence. Foreign checks must be sent for collection and are subject to exchange rates and collection fees.

Payments must be mailed to:

Boston College Student Services

140 Commonwealth Avenue

Lyons Hall Room 103

Chestnut Hill, MA 02467-0123

Loan Options

Federal Direct Loans

Federal PLUS Loans

Private Loans

My Bill

My Bill is Boston College’s electronic student account billing and payment system. Students and authorized third-party payers can make an online payment using My Bill.

To configure and use My Bill:

- Students should log into their Agora Portal account and select "My Bill."

- To authorize third-party payers, students should select the "My Bill" link in their Agora Portal account and select "Authorize Payers" from the menu bar.

- Once authorized, third-party payers can view and pay bills at:

Note: Access to My Bill requires two-step verification. Two-step verification is utilized to further protect your student account in the event your password ever becomes compromised. Students can set up two-step verification by visiting www.bc.edu/2step. Students who do not set up two-step verification in advance will be prompted to do so upon accessing My Bill in Agora Portal.

Two-step verification does not apply to authorized payers on the student's account.

Web Payment

Guests who are not authorized third-party payers and who do not have access to My Bill can make an online payment using the web payment method. Guests who use this method of payment will need to know the student's Eagle ID number as well as his or her month and day of birth.

International Wire Payments

Boston College has partnered with Flywire and Convera (formerly Western Union Business Solutions) to offer an innovative and streamlined way to make international tuition payments. Our goal is to save international students and their families money that would otherwise be lost on bank fees and unfavorable foreign exchange rates. With these two agencies, you are offered excellent foreign exchange rates, allowing you to pay in your home currency (in most cases) and save a significant amount of money, as compared to traditional banks. In addition, the posting of the payment into your Boston College account will be faster, and you will be notified via email when it is received.

Visit www.flywire.com/pay/bc or https://students.convera.com/ to begin the payment process.

- To get started, select the country from which funds will be coming and the payment amount in U.S. dollars (a minimum of $50) you wish to make to your student bill.

- In most cases, the U.S. dollar amount will be converted into your home currency at preferential exchange rates, which will translate into savings for you.

- After providing some additional basic information, you will book the transaction and will be instructed via email on how to pay from your home country bank account.

- The agency will then forward the U.S. dollar amount to Boston College where it will be directly credited to your student billing account.

- You will receive an email to confirm receipt of payment.

- At any time, you will have a dedicated customer service team to answer any of your questions.

U.S. Wire Payments

Payments via wire transfer (in U.S. dollars) should be made at least seven days in advance of the due date and must include the student's full name and ID number. Transfers should be made directly to Bank of America. Please contact the Office of Student Services for routing and account information.

Payment Plans

Undergraduate and Law Students

Boston College partners with Nelnet to offer the interest-free QuikPAY Payment Plan to undergraduate and Law School students. Enrollment for the 2025–2026 academic year begins on May 2, 2025. The payment plan is open for enrollment until August 25 (for annual and fall-only plans) and December 25 (for spring-only plans). However, we advise enrolling by August 8 (annual and fall-only plans) or December 9 (spring-only plans) to meet the billing deadlines.

Payments are made by automatic debit from a U.S.-based checking or regular savings account and are processed on or near the tenth of each month. Annual (ten-month) plans begin in June and continue through March, fall semester plans begin in June and continue through October, and spring semester plans begin in November and continue through March. The first payment is deducted on June 10, so depending on when you enroll, you may have to make up missed payments. For plans that require the down payment of missed payments, the down payment amount is processed at the time of enrollment. Please refer to the schedule below for enrollment deadlines, down payment requirements, and payment dates.

QuikPAY Payment Plans are maintained within My Bill, BC's online billing and payment system. Students can access My Bill in the Agora Portal. Parents must first have Authorized Payer accounts created by the student, and then can log in at www.bc.edu/mybillparent. Parents should sign up under their own Authorized Payer account so that they do not miss important payment updates.

For assistance with enrolling in or maintaining a plan, please contact Nelnet Business Solutions at 888-470-6014 or the Office of Student Services at 800-294-0294.

Fees

- Enrollment Fee—$50 for the annual plan, $30 for one-semester plan

- Returned Payment Fee—Nelnet charges a returned payment fee. Boston College cannot refund this fee.

Annual (Fall and Spring Semesters) Plan Schedule

Enrollment begins May 2, 2025

| Enroll By | Down Payment for Missed Payments | Number of Payments | Payment Dates |

|---|---|---|---|

| May 30, 2025 | none | 10 | June 10 to March 10 |

| June 30, 2025 | 20% of fall budget | 9 | July 10 to March 10 |

| July 30, 2025 | 40% of fall budget | 8 | August 11 to March 10 |

| August 8, 2025 | 60% of fall budget | 7 | September 10 to March 10 |

Fall Semester Only Plan Schedule

Enrollment begins May 2, 2025

| Enroll By | Down Payment for Missed Payments | Number of Payments | Payment Dates |

|---|---|---|---|

| May 30, 2025 | none | 5 | June 10 to October 10 |

| June 30, 2025 | 20% of fall budget | 4 | July 10 to October 10 |

| July 30, 2025 | 40% of fall budget | 3 | August 11 to October 10 |

| August 8, 2025 | 60% of budget | 2 | September 10 to October 10 |

Spring Semester Only Plan Schedule

Enrollment begins on September 5, 2025

| Enroll By | Down Payment for Missed Payments | Number of Payments | Payment Dates |

|---|---|---|---|

| October 30, 2025 | none | 5 | November 10 to March 10 |

| November 30, 2025 | 20% of spring budget | 4 | December 10 to March 10 |

| December 10, 2025 | 40% of spring budget | 3 | January 12 to March 10 |

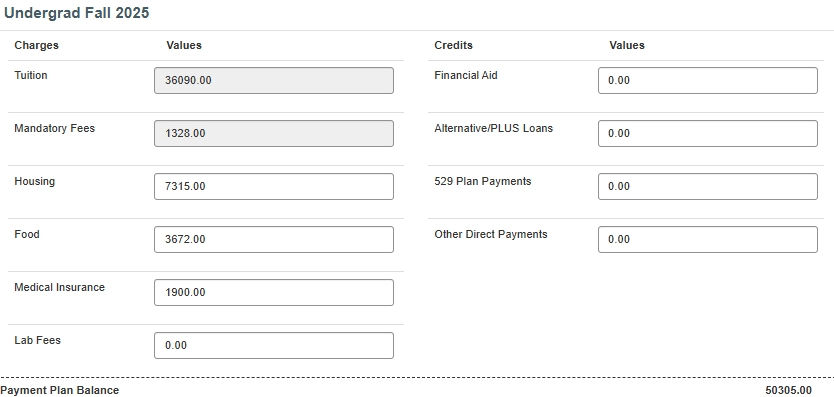

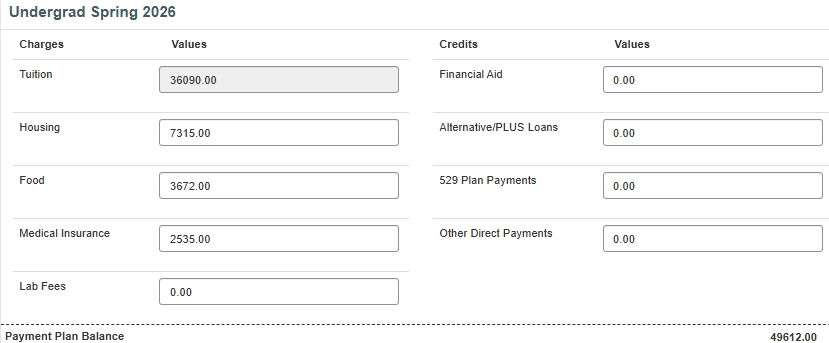

When enrolling in the plan, use the budget worksheet in QuikPAY to calculate the amount of your plan. The budget worksheet is prefilled with default figures based on the student's school and class level. To create an accurate budget, students and families will need to adjust the default figures based on their individual situations.

Payment plan balances will later be adjusted to match actual student account balances after charges and financial aid credits have been applied. Adjustments will begin in August for the fall semester and December for the spring semester. Changes to plan balances will be distributed evenly over the remaining payments for the semester. Appropriate notifications will be made prior to scheduled payment amounts being changed. In order to minimize the potential impact of balance adjustments, it is very important to complete the balance worksheet carefully at the time of enrollment.

Examples of QuikPay Budget Worksheet

How to Complete the Budget Worksheets

See below for more details on how to complete the budget worksheet fields.

Charges

- Tuition and Mandatory Fees: These amounts are based on the student's school and class level and cannot be changed. Mandatory fees are charged only in the fall semester.

- Housing:

Incoming freshmen: All incoming freshmen are charged the same rate for housing, and the budget worksheet will reflect these charges. Commuting students should contact the Office of Student Services for assistance adjusting the housing and food amounts.

Returning undergraduates: Returning undergraduates are charged different room rates based on their respective residence halls. The worksheet defaults are an estimate and should be manually adjusted. For more information, visit the Residence Hall Rates dropdown on the Tuition and Fees web page.

- Food (undergraduate students only): The amount on the budget worksheet is the default amount for meal plans. If a student is selecting a different meal plan, this amount should be adjusted. Returning undergraduates living in residence halls with kitchen facilities are not charged for the mandatory board plan. If a student plans to opt out of the meal plan or purchase a Flex dining plan, the amount of food should be adjusted on the worksheet.

- Medical Insurance: All BC students are required to be covered by a health insurance plan. The budget worksheet includes the cost of the student plan, offered by Boston College through UnitedHealthcare. Students who are covered by a comparable plan may opt out of participation in the student plan by submitting an annual waiver. If the student has or will waive the BC coverage, the amount in the worksheet should be changed to zero. For more information, visit the Medical Insurance web page.

- Lab Fees: The default value for this field is zero. If a student is or will be registered for any course or courses that carry an associated lab fee, the appropriate charge should be entered. For more information, visit the Laboratory Fees tab on Tuition and Fees web page.

Credits

- Financial Aid: This field should be used to report the total of the student's financial aid awards for the corresponding semester. Work-Study awards should not be included as they do not credit to the student's account. If the student is expecting to receive any scholarship awards from sources outside of BC that are not already listed on his or her financial aid award, they should be included here. In addition, the student should notify the Financial Aid Office of the awards so that the aid package can be adjusted.

- Private/PLUS Loans: This field should be used to report any approved loan applications. It is important to note that loan applications are subject to review by the Financial Aid Office. Payment plan balances should be reviewed once any loan applications have been processed.

- 529 Plan Payments: This field should be used to report any anticipated payments that will be made directly to BC from qualified 529 Plans. In addition to reporting these amounts on the balance worksheet, students or parents must notify the Office of Student Services of the source and amount of any anticipated payments so that a pending credit can be posted to the student account. The pending credit will then be factored in when the payment plan is later adjusted to match the student account balance.

- Other Direct Payments: This field should be used to report any anticipated payments that will be made directly to BC apart from the payment plan process, e.g., payments from relatives. If these payments will not be made prior to the point when payment plan balances begin to adjust based on student account balances, students or parents must notify the Office of Student Services of the source and amount of any anticipated payments so that a pending credit can be posted to the student account. The pending credit will then be factored in when the payment plan is later adjusted to match the student account balance.

Graduate and Woods College Students

All graduate and Woods College of Advancing Studies students who wish to use the Boston College Payment Plan (BCPP) are required to make a minimum down payment of 25% of the semester charges. A 3% participation fee will be assessed on the remaining balance. This deferred balance is then divided into three installments.

Upon receipt of the BCPP Enrollment Form, the Office of Student Services will send participants a confirmation of enrollment and a payment schedule. Monthly billing statements may be viewed under "My Bill" in Agora Portal. My Bill is Boston College’s electronic student account billing and payment system. Prior semester balances must be resolved before you may participate in this plan.

If you failed to make payments as agreed under the BCPP program during a previous semester, you are not eligible to enroll in this plan for subsequent semesters and will be required to pay in full by the due date. Students who anticipate a problem with paying their bill should contact the Office of Student Services.

Messina Students

Families of Messina students who anticipate any issues with paying their bill by the due date should contact Matthew Meegan at (617) 552-4992 or matthew.meegan@bc.edu. We would be happy to discuss payment plan options with you or suggest alternative financing.

Loans and Scholarships

Federal regulations require that Title IV funds credited to your student account be applied only to cover allowable charges, unless Boston College obtains authorization to apply these funds to all other charges on your student account. You may submit your authorization electronically in the Agora Portal.

Title IV Federal Financial Aid Funds

- Pell Grants

- SEOG

- Perkins Loans

- Federal Direct Loans

- Undergraduate Parent PLUS Loans

- Graduate PLUS Loans

- TEACH Grant

Allowable Charges

- Tuition

- Mandatory fees

- Housing and food

Non-Allowable Charges (include but are not limited to)

- Parking permits

- Medical insurance

- Replacement ID fees

- University Health Services fees for service

- Other miscellaneous fees

Without your authorization, Title IV funds credited to your student account cannot be applied to non-allowable charges. This may result in a refund being automatically issued to you that creates a balance due on your account. The resulting student account balance becomes your responsibility to repay.

Example Student Account

| Tuition and mandatory fees | $10,980 |

| Medical insurance premium | $966 |

| Parking permit | $259 |

| Total charges | $12,205 |

| Federal loan disbursements | ($12,205) |

With your authorization to apply Title IV funds to all charges, the resulting balance on your student account is $0. No automatic refund would be issued.

Without your authorization to apply Title IV funds to all charges, the resulting balance on your student account is still $0. However, $1,225 of the charges is not considered allowable. An automatic refund of $1,225 would be issued from your student account, and the result would be a balance due of $1,225. It would then be your responsibility to remit payment for that amount back to Boston College.

Your authorization is voluntary. It is valid for the duration of your academic career at Boston College, and it can be canceled at any time in the Agora Portal. Any cancellation or modification requests will take effect on the date that we receive the request.

Outside sponsored scholarships, Federal loans, and private loans may be disbursed to Boston College by either paper check or electronically. Documentation of the scholarships being remitted by a source other than Boston College should be submitted in advance of the due date. Note: Students must report scholarship information on their financial aid application materials, as well as submit the outside scholarship award letter(s) and check payment(s) to the appropriate mailing addresses. For more information, visit the Outside Scholarships tab on the Types of Financial Aid web page.

When these funds are received, Boston College conducts a review of the student status to ensure that the student is eligible to receive the funds. After this review, the student will receive notices if action is required by the student in order to meet eligibility requirements. Any of the conditions listed below may prevent your scholarship or loan from crediting to your Student Account. If you have received a notice of outstanding requirements, please follow the instructions for each condition that is identified for your scholarship or loan.

- Endorse Check: Go to the Office of Student Services, Lyons Hall 103 (phone: 617-552-3300), to endorse your check. Please note that all other requirements, including being registered at least half-time (normally for a minimum of 6 credits), must be completed prior to being allowed to endorse your check.

- Register for Classes: Federal regulations require that you be registered at least half-time (normally a minimum of 6 credits) prior to receiving your loan proceeds. Please register for the appropriate number of credits to receive your funds. This may include Master's Interim Study or Doctoral Continuation, if applicable.

- Mailed for Endorsement: Your check for this disbursement was mailed to you for your endorsement. Once you have received it, please endorse the check and return it to Office of Student Services in the envelope provided.

If a student has completed the financial aid process for Federal Direct or Nursing loans, the amount for the semester (less applicable fees) has been deducted as a pending credit from the balance due on his/her statement.

- Recipients awarded Nursing loans are required to sign a Master Promissory Note (MPN) once per year before proceeds will be credited to the student's account.

- State scholarships, outside scholarships, the QuikPAY payment plan, Pell Grants, and other forms of aid that may be included in pending credits are applied to the student's account as they are received by the University.

- Students receiving awards from outside agencies should make sure that the Office of Student Services is aware of these awards, particularly if a bill needs to be sent to the agency before funds will be remitted.

- Outside scholarships that are not already credited to the student's bill may be deducted from the balance due, provided they are not contingent upon grades and that documentation of the award has been sent to the Office of Student Services.

If the University does not receive the funds for the pending credits listed on your statement, you will be responsible for payment of the total balance on your student account. If the amount of the pending credits received for outside scholarships exceeds the amount reported to Student Services during the financial aid process, an aid adjustment may be required.

Requesting a Refund

Student Account Refund

When your student account has a refund balance on it, you may request a refund to be sent to you. The refund can be the result of financial aid, loans, or simply overpayment. To request a refund, go to "Account and Personal Information" in your Agora Portal and select "Request Student Account Refund".

Note: Student Services cannot approve refunds of under $5.

Spring 2026 Refund Availability Information

Financial aid refunds will be available after your student loan is disbursed to your student account. Please monitor your account and log in to portal.bc.edu to request your refund when you see the refundable balance.

Refunds will be processed as direct deposit. If you have not done so, please follow the instructions to enroll in direct deposit at www.bc.edu/refund.

Enroll in Direct Deposit

We recommend that all students use direct deposit when requesting refunds. Refunds processed via direct deposit are faster and do not require pickup. Keep in mind that direct deposit for employment is separate from direct deposit for your student account.

Please take the time to enroll in direct deposit for your student account in the Agora Portal.

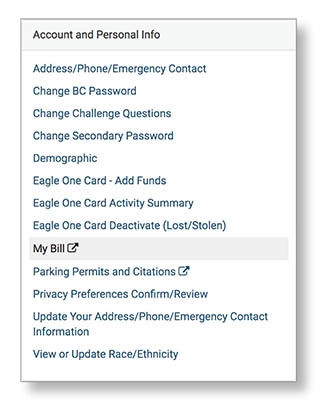

First, select “My Bill” under “Account and Personal Info”:

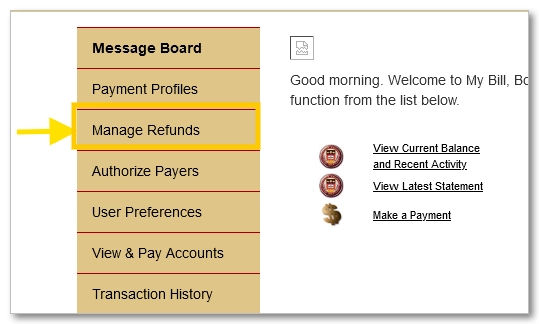

Second, on the left hand navigation bar, select "Manage Refunds":

Then "Manage My Refunds":

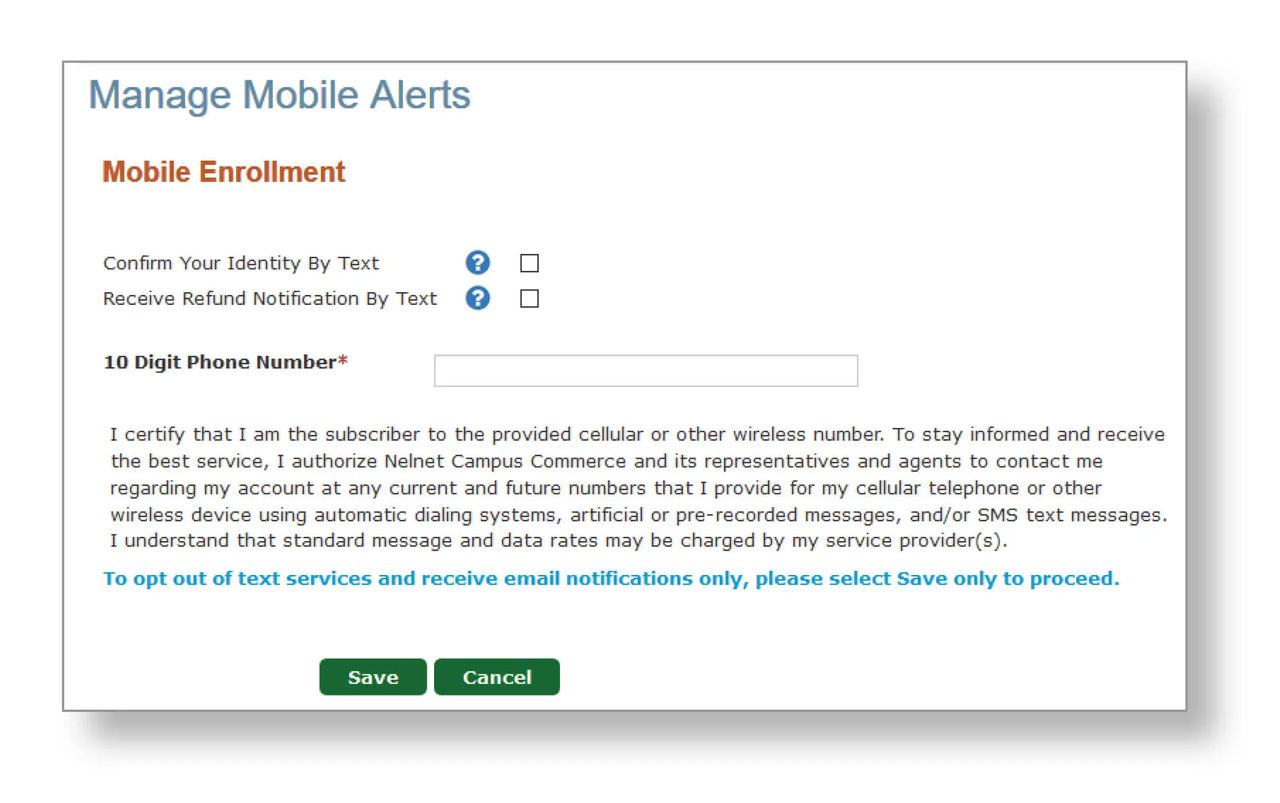

Third, enroll in SMS notification to confirm your identity:**

**Please note that if you do not want to enroll in texts/SMS alerts, leave all fields blank and hit the green Save button.

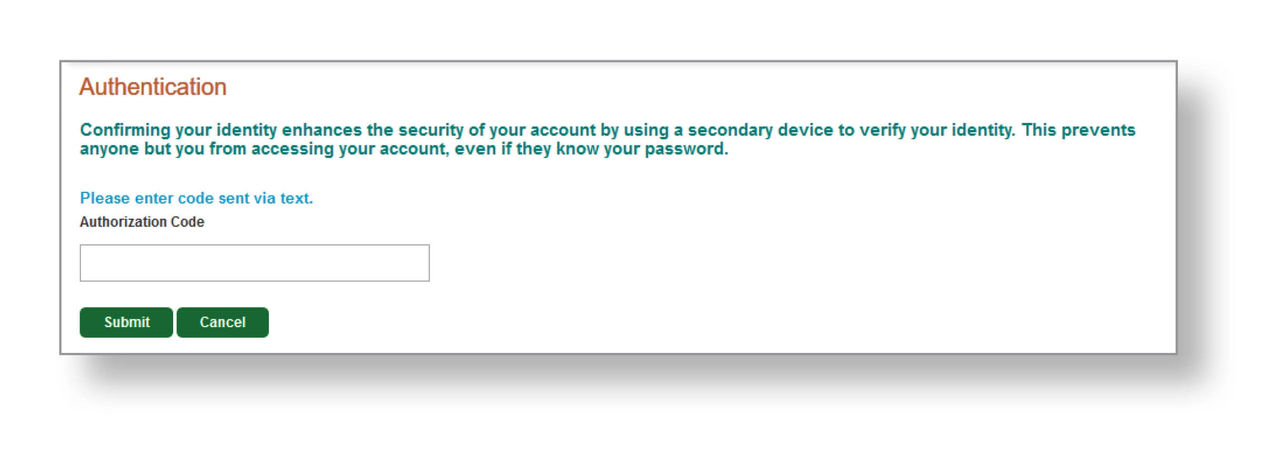

Fourth, enter the Authorization Code to continue your enrollment:

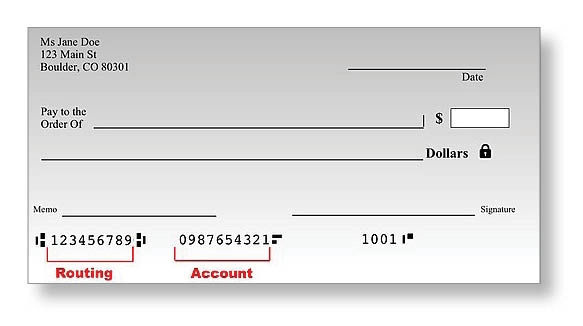

Fifth, select “Edit Refund Method” on the Student Choice Refunds page and enter your bank information:

Note: You will need to enter a valid United States bank routing and account number. You can find these numbers on any check:

If you have any questions about student account direct deposit, contact the Office of Student Services at 617-552-3300 or 800-294-0294, or email us at studentservices@bc.edu.

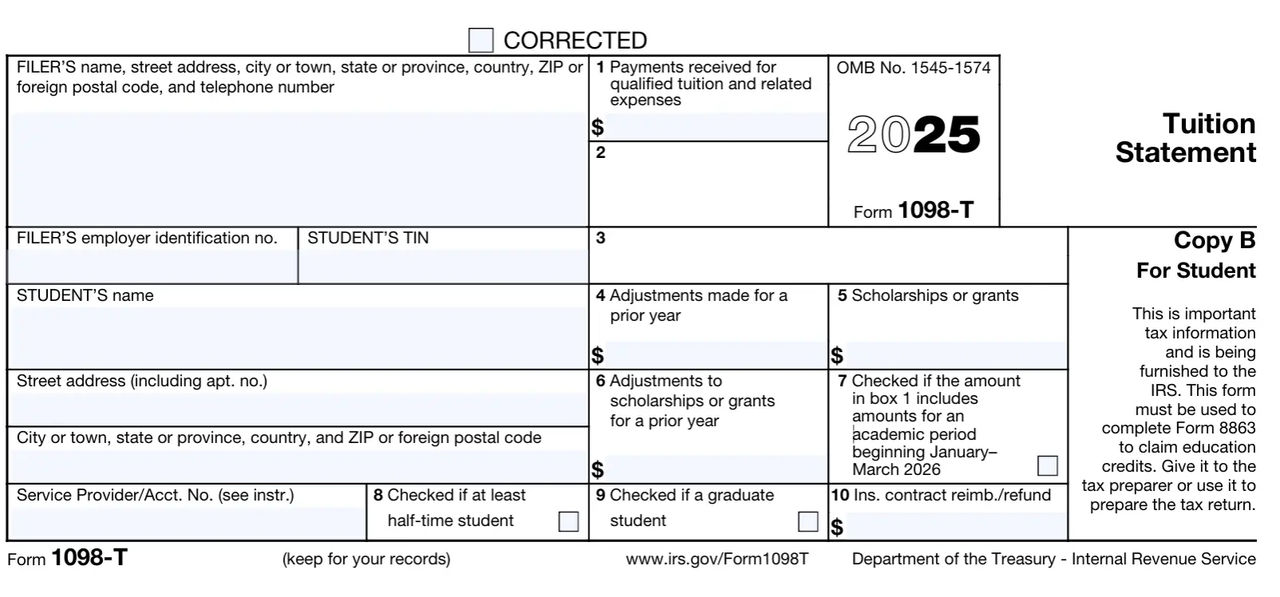

IRS 1098-T

Under the Taxpayer Relief Act of 1997, certain tax benefits may be available to students who have incurred qualified expenses for higher education. To assist you in the determination of eligibility for an education tax credit, Boston College provides Form 1098-T.

1098-T forms are mailed annually by January 31. If you consented to receive the form electronically, you will receive an email notification when the form is available online. The 1098-T form is for informational purposes only, and, while you should retain a copy for your records, you are not required to submit it with your tax return. The information reported to students on Form 1098-T is also reported by Boston College to the IRS.

Boston College is required to report this information to the IRS, along with your Social Security Number or Tax Identification Number. If you have not already provided this information on your admissions or student employment application, please complete and submit IRS Form W-9S (PDF) to the Office of Student Services. Students are required by the IRS to provide this information to their college or university to facilitate 1098-T reporting.

Boston College cannot provide you with tax advice. If you need assistance in determining how to report this information on your tax return, please refer to IRS Publication 970 (available on the IRS website), or consult a licensed tax preparer.

You can view and print your 2025 1098-T form by visiting Heartland ECSI’s website at https://heartland.ecsi.net/. For forms prior to 2017, please contact Student Services at 800-294-0294. If you have trouble accessing your 1098-T form, please contact ECSI at 866-428-1098 or by live chat on their website.

If you authorized receiving your form electronically, you will receive an email notification when it is available online. Otherwise, your 1098-T form is mailed to your home address on file at Boston College. Please be sure to keep your address up to date to ensure proper delivery of future correspondence from Boston College. You can review and update your address information in the Agora Portal.

In prior years, your Boston College 1098-T reported the total qualified expenses that were billed to your account in Box 2. Due to a change in IRS regulations, Boston College is now required to report your total qualified expenses paid in Box 1.

Qualified expenses are limited to tuition and certain related expenses required for enrollment in a course. Room, board, and miscellaneous charges such as fees for parking permits or medical insurance premiums are not included.

The information on Form 1098-T is based on the amounts paid in 2025. Because charges for the spring semester are typically billed in November, you may have made payments at the end of 2024. Therefore, these amounts would not appear on the 2025 1098-T form.

Box 7 indicates that the amount in Box 1 includes amounts paid for an academic period that takes place in the next calendar year. If this box is checked, you may be eligible to claim a tax credit in either year. You should consult a licensed tax preparer for specific information about your potential eligibility.

Per IRS requirements, the 1098-T reports information for a calendar year (January 1 through December 31). Because spring charges can be applied between November and January, you may have made payments at the end of 2024 rather than in 2025. The spring semester information may be correctly reported on your 1098-T forms but not for the year that you were expecting. You can verify the timing of your payments by reviewing your billing statements in the “My Bill” section of your student account. You may use your personal financial statements (billing statements) as supporting documentation rather than the 1098-T to determine your eligibility for education tax credits.

International Student Tax

Tax Requirements for International Students Receiving Scholarships

As a non-U.S. Citizen, certain portions of your scholarship may be subject to a 14% Federal Tax unless your home country has a tax treaty with the United States.

All new international students must present their immigration documents to the Human Resource Service Center at 129 Lake Street (Brighton Campus). Please make an appointment by calling 617-552-HRSC.

If you are subject to this tax it will appear on your student account as Non-Resident Alien Fed Tax.

Details regarding this federally required tax may be found on the Internal Revenue Service’s website at: https://www.irs.gov/individuals/international-taxpayers/nra-withholding.

Scholarship Funds Subject to Tax

| Tuition | No |

| Mandatory Fees (e.g., Student Activity Fee) | No |

| Books | No |

| Room (Housing) | Yes |

| Board (Meal Plan) | Yes |

| Miscellaneous/Stipends | Yes |

| Medical Insurance | Yes |

Athletic Meal Plan

If you are a Boston College student-athlete, your meal plan accommodates your unique nutritional needs. You are able to purchase meals beyond the initially billed amount—any overage will be charged to your student account at the end of each academic year and will be listed as Supplemental Meal Plan. Scholarship funds used to cover this overage are taxed at 14% just like all meal plan charges however, this portion of the tax will not be added to your account until the end of the academic year.

Contact

If you have additional questions or concerns about your requirements as an international student, please contact the Office of International Students and Scholars.

If you have any student account or financial aid concerns, please contact the Office of Student Services.

Frequently Asked Questions

To authorize Third-Party Payers go to the “My Bill” link in the Agora Portal, which will take you to BC's online billing website, QuikPAY. Select “Authorize Payers” from the menu bar, then follow the instructions. You will be asked to provide email addresses and temporary login names and passwords for all Third-Party Payers. Once authorized, they will be notified by email of a pending bill. The authorized payer may view statements and make online payments through a link to QuikPAY in their email notification. They must type in the login name and password you assigned them. Authorized payers can also directly log in to QuikPAY using www.bc.edu/mybillparent.

The student must reset the password if an Authorized Payer loses or forgets his/her password. The student will click the "Reset Password" from within the Authorized Payer's section of QuikPAY. A randomly generated password will be emailed to the primary email address on the Authorized Payer's account. The student will not have access to the new password.

The Third-Party Payer can use the same password and email address for all accounts, but the login name for additional family members needs to be different. For example, if the login name for the Third-Party Payer is "billdad," the second student could assign "billdad2" as the login name for the same Third-Party Payer. Authorized payers can log in to QuikPAY using www.bc.edu/mybillparent.

Authorized Third-Party Payers can pay tuition and fees bills through the system's online payment feature. Authorized payers can log in to QuikPAY using www.bc.edu/mybillparent. Checking and savings account information from a bank within the United States can be entered on the QuikPAY website. Payments will be transferred electronically to Boston College. You may keep your bank account information on the website or enter it each time you make an online payment.

To ensure security and privacy, each Authorized Payer is assigned a separate password to access his/her account and payment history. No one else, not even the student, will be able to view a Third-Party Payer's confidential account information.

Authorized payers can also print the bill and send a check or money order (no cash) made payable to Boston College through the mail to the following address:

Boston College

Office of Student Services

Lyons Hall

140 Commonwealth Avenue

Chestnut Hill, MA 02467

Boston College does not accept credit card payments for tuition, fees, or housing and food except for students in the Woods College of Advancing Studies.

Boston College has partnered with Flywire for foreign payments. For more information, visit the Make a Payment tab on this page.

If you qualified to receive a 1098-T form for tax year 2022 and received CARES or HEERF Act funding, the value of the grant will not be reported on your 1098-T.