Originally published in Carroll Capital, the print publication of the Carroll School of Management at Boston College. Read the June 2025 issue here.

Carroll School researchers have lately investigated business questions ranging from the micro—how does one maintain a career identity amid life’s unpredictability?—to the macro—do companies avoid mergers that could annoy their customers? If anything unites this work, it’s the idea that the business world seldom operates as you’d expect.

Making Sweet Music of Messy Careers

Careers, like our messy lives, are complicated. A career might be summarized in a tidy narrative, yet can come with side gigs, sabbaticals, and second acts. Put simply, it can change, and that creates tension as someone puzzles out a career identity. In a paper published in the Academy of Management Review, Management and Organization Professor Jamie Ladge and colleagues put forward a theory that reconciles the anchoring effect of an enduring identity with the day-to-day reality of unexpected events and evolving skills. Under their formulation, people continually both maintain and modify their career identity. They mentally balance whatever they see as their career through line with new opportunities and unexpected detours. This process—called career identifying—“allows individuals to adapt and accommodate a wide variety of career-related thoughts and actions while also holding a stable enough self-definition to serve as a reference point,” the coauthors write.

The Dirty Business of Being Green

Companies are like people: They want to look good. If they can do that easily, so much the better. For example, Coughlin Family Professor of Finance Ran Duchin and colleagues have shown that, when pressured to be more sustainable, public companies don’t necessarily cut their pollution. Instead they sometimes just sell off their polluting plants to their suppliers. And sure, the sellers do end up seeming greener—their operations appear less polluting since the dirty plants move off their books—but the world remains just as smoggy as before. Duchin and coauthors write in the Journal of Finance that this conduct smacks of greenwashing, in which companies try to look more sustainable without making real changes, so their “divestment of pollutive plants reflects a cosmetic redrawing of firm boundaries.” The researchers also find that corporate greenwashers can be shameless: Sellers will often talk up their commitment to sustainability in conference calls with investors after they’ve sold off polluting plants.

More Faculty Research

See a sampling of faculty research, media highlights, and awards.

Putting Words in Their Mouths

If a friend were to post on social media about a brand experience they had, you’d probably think the content was their own. Think again. Some companies are now creating content for consumers to share—going beyond the standard practice of simply asking consumers to post about their experience. That can work remarkably well, according to an article by Accenture Professor of Marketing Katherine N. Lemon and coauthors in the Journal of Marketing. They refer to this as “firm-generated user content,” or FGUC—crafted for consumers “to share as their own.” In one of several lab and field studies, the researchers compared a typical request for consumer-generated content—“Please consider posting about us on Twitter [X]”—with an FGUC that commended the product or service. The basic findings: Provided content “increases the likelihood that consumers share a post about their experience, by making the sharing process easier,” while also tempering negative opinions and thus lessening the chances of dissatisfied consumers sharing posts.

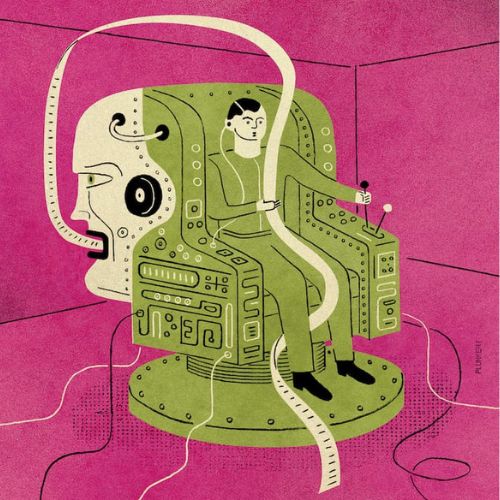

Does Pay Complexity Intoxicate CEOs?

With alcoholic beverages, moderation is key. That goes also for the features of executive pay plans, as Joseph L. Sweeney Chair and Professor of Accounting Mary Ellen Carter and colleagues find. With too many pay-plan features, as with too many drinks, CEOs can lose their bearings. Yet corporate pay plans are becoming ever more complicated, Carter and coauthors report in the Journal of Accounting and Economics. From 2006 to 2019, corporate boards added more of everything—kinds of pay (stock options, restricted stock, etc.), performance targets and measurement periods, and benchmarks. They were trying to better link pay to performance, but companies mostly ended up doing worse as CEOs paid attention to too many metrics and lost sight of what’s important. The researchers offer a warning: “Our study suggests that compensation contracts that include features that may be optimal individually can become suboptimal overall when many features are aggregated.”

Don't Let a Crisis Go to Waste

A big data breach doesn’t just embarrass a company. It also says its IT systems can’t ward off hackers. When firms learn that, they do the sensible thing and hire more cybersecurity experts, especially in management and monitoring roles, according to Business Analytics Professor Sebastian Steffen and colleagues. Breached firms bring in more public relations staffers, too, the researchers find in an MIS Quarterly paper—which underscores the reputational damage that big hacks can cause. Interestingly, the PR hires happen quickly—perhaps as companies scramble to reassure customers and investors amid a crisis—while the cybersecurity ones don’t come till several months later. Little research had examined hiring after big hacks because data was scarce. By combining information from several sources, Steffen and coauthors were able to link breaches and companies’ staffing responses.

Keep Your Friends Close and Your Customers Closer

Not annoying your customers would seem a commandment of business. Yet that simple idea can manifest in surprising ways. Take mergers and acquisitions. Accounting Professor and Clark Family Fellow Benjamin Yost, with colleagues including Farzana Afrin, Ph.D. ’22, show that firms don’t just consider themselves when pondering mergers and acquisitions. They also think about their customers—not consumers, but companies they do business with. Yost and his coauthors find that companies avoid pairing up with customers’ rivals or the suppliers to those rivals, because these mergers would put their customers at a competitive disadvantage. Mergers entail extensive exchange of information between the parties, and sensitive details about the customers could be shared—which the rivals or suppliers then could use to undercut the customer. “Suppliers who undertake such mergers risk damaging or losing their existing relationships with their customers,” the researchers write in the Journal of Accounting Research.

This Free Advice May Cost You

In the world of corporate governance, proxy advisory firms loom large. They produce reports on public companies’ governance and make recommendations about how shareholders should vote in corporate elections on questions like who should serve on the board. Investors and researchers have long debated the worth of their reports and advice. Hillenbrand Family Faculty Fellow Andrey Malenko, Wargo Family Faculty Fellow Nadya Malenko, and a colleague argue in the Journal of Finance that proxy advisors' reports do have value, but their voting recommendations should be interpreted in light of their desire to sell those reports. Advisors, the finance professors say, want to stir up controversy because doing that creates greater demand for their reports. So they’ll often make voting recommendations, which they give away for free, that contradict a corporate vote’s likely outcome (typically the one favored by management of the company holding the vote). In short, they’ll use their voting tips to gin up sales of their reports.