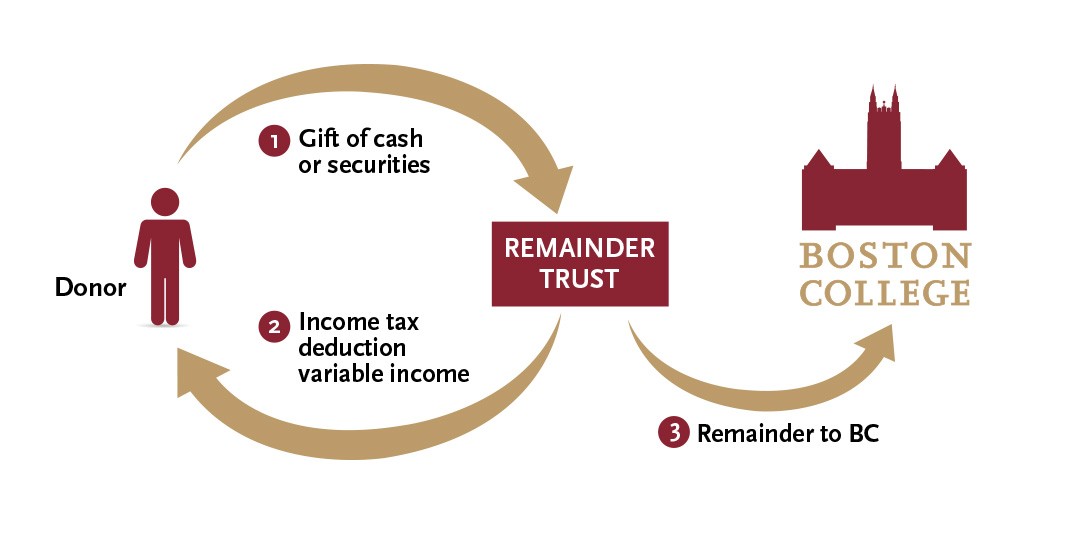

Charitable Remainder Trusts

How It Works

In exchange for cash, securities, real estate, or tangible assets you and/or your beneficiaries will receive an income stream for life or a fixed term of years. At the passing of the named beneficiaries, BC will receive the remainder of the gift.

With a minimum of $100,000, you can establish two types of remainder trusts at BC:

- Charitable Remainder Unitrust (CRUT): pays a variable stream of income, which is equal to a fixed percentage of the fair market value of the trust during that year

- Charitable Remainder Annuity Trust (CRAT): pays a fixed stream of income, which is equal to a fixed percentage of the funding value of the trust.

Alternatively, you can fund a Charitable Remainder Trust through your estate to provide income to your named beneficiaries after your passing. In addition to providing income to your heirs, a testamentary CRUT can reduce your estate taxes.

Next Steps

- Contact the Office of Gift Planning to start the process, ask questions, and get personalized calculations

- Try our gift calculator to understand your options.

BC’s legal name, address and tax ID:

The Trustees of Boston College

140 Commonwealth Avenue

Chestnut Hill, MA 02467

Tax ID 04-2103545

Related Content

AT A GLANCE

WHO

- Age 50+ (or younger for a term of years)

WHAT

- Cash

- Securities

- Real estate

- Personal property

- Business interest

WHEN

- Now and after death

WHY

- Receive payments for life

- Potential for growth of income over time

- Supplement retirement income

- Receive a charitable deduction

- Avoid capital gains tax

- Save on gift and estate taxes

- Support the future of BC at a level you didn’t think was possible

- Become a member of the Shaw Society

How Can We Help?

We're here to partner with you if you have any questions. Feel free to reach out to us directly or fill out the form.