This sampling of recent research from Carroll School faculty includes papers appearing in leading academic journals across management disciplines. Among them: Management Science, Administrative Science Quarterly, Organization Science, Academy of Management Journal, Journal of Consumer Research, Journal of Marketing, Journal of the Academy of Marketing Science, Review of Finance, Journal of Financial Economics, MIS Quarterly, Journal of Service Research, Manufacturing & Service Operations Management, Operations Research, Journal of Business Ethics, Research Policy, Journal of Accounting Research, and Accounting, Organizations and Society.

Professor Jean Bartunek (Management and Organization) has edited a new book, Social Scientists Confronting Global Crises, scheduled for release by Routledge in December. Against the backdrop of dire emergencies on the world stage, Bartunek and a raft of contributors unpack the social dynamics and complex human interactions that can heal or heighten such large-scale traumas. One premise of the book (which includes chapters authored by 20 prominent scholars and practitioners) is that experts in the natural sciences aren’t the only ones who have vital perspectives on crises such as climate and COVID. Social scientists are engaged as well, helping to forge solutions to these crises. Bartunek holds the Robert A. and Evelyn J. Ferris Chair of Management and Organization at the Carroll School.

Associate Professor of Accounting and Ernst & Young Faculty Fellow Mary Ellen Carter

Recently, Associate Professor and Ernst & Young Faculty Fellow Mary Ellen Carter (Accounting) and co-researchers examined board members who concurrently serve on two key committees, audit and compensation. Their key finding is that those committees make different decisions than they might have if there were no overlap. Specifically, the researchers identified a distinctive pattern: that when compensation committee members also sit on the board’s audit committee—which is the body accountable for accurate financial reporting—the CEO’s bonus is tied less to the firm’s earnings performance than to other metrics. The co-authors include Luann Lynch, of the Darden School of Business, and Melissa Martin, of the University of Illinois Chicago. Their paper, “Board Committee Overlap and the Use of Earnings in CEO Compensation Contracts,” will be published in Management Science.

Professor of Accounting Jeffrey R. Cohen and colleagues draw on social identity theory to evaluate how audit committee members’ experiences outside the committee affect the way they carry out their responsibilities and make judgments as committee members. Co-authored by Kara M. Obermire (Oregon State University), Cohen, and Karla M. Zehms (University of Wisconsin-Madison), the article is titled “Audit committee members’ professional identities: Evidence from the field,” and is forthcoming in Accounting, Organizations and Society. Cohen also co-authored “Non-audit Engagements and the Creation of Public Value: Consequences for the Public Interest” with Canadian scholars Bertrand Malsch (Queen’s University) and Marie-Soleil Tremblay (École Nationale d’Administration Publique). That article will appear in the Journal of Business Ethics.

“The companies that emerge stronger because of disruption are those that used it as an opportunity for innovation,” Professor of Information Systems Gerald C. Kane and co-authors write in The Transformation Myth: Leading Your Organization through Uncertain Times, published in September by The MIT Press. Their conversations with some 50 top executives and thought leaders suggest that business leaders agree strongly with that thesis, with 75 percent of CEOs indicating that the COVID-19 crisis created significant opportunities for their companies. In addition to academic research that included surveys of more than 21,000 executives, the book relies on advisory work with companies on how they are practically navigating disruption to understand and evaluate possible responses to disruption. Kane’s three co-authors—Rich Nanda, Anh Nguyen Phillips, and Jonathan R. Copulsky—are or have been management consultants at Deloitte. The Wall Street Journal has been running a series of excerpts from the book.

The service industry was forced to transform itself in 2020. For service researchers, too, the challenges posed by the global pandemic call for a shift in focus—but in which direction? Associate Professor of Business Analytics Joy M. Field and Accenture Professor of Marketing Katherine N. Lemon, along with several colleagues, use a range of sources and methodologies as they show how the service discipline can develop a coherent set of priorities for research and practice, amid transformative changes in society and service. They define four key priorities for service research, two of which focus on technology and two more on the shifting needs of multiple stakeholders. Their findings are presented in “Service Research Priorities: Managing and Delivering Service in Turbulent Times,” published in the Journal of Service Research in July. Field, Lemon, and colleagues also have a related article, “Service Research Priorities: Designing Sustainable Service Ecosystems,” published in the same journal in September.

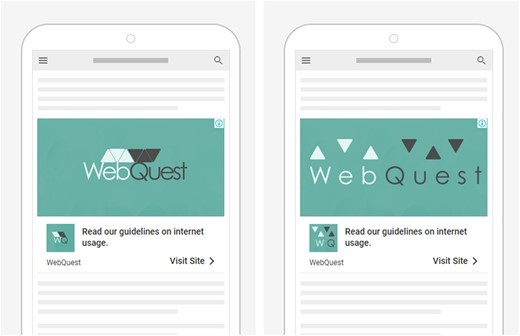

Two sample logos from Hagtdevt's study, one with more compact lettering (left) and one with "looser lettering" (right).

The design of a company logo—in particular, the letter spacing—is not something to be taken lightly, according to new research from Associate Professor Henrik Hagtvedt and a colleague, Tanvi Gupta. The associate professor of marketing explained his findings in a BC News story last spring: customers perceive companies whose logos have compact lettering—that is, less space between each letter—as secure and stable, whereas looser lettering can convey vulnerability. Hagvedt and Gupta also reveal how these perceptions are tied to cultural identity in their article, “Safe Together, Vulnerable Apart: How Interstitial Space in Text Logos Impacts Brand Attitudes in Tight versus Loose Cultures,” which appeared in the Journal of Consumer Research earlier this year.

Travel and retail companies like Hotwire and Priceline have been using opaque selling for years. The strategy of offering overstock at a discount and hiding the identity of the product or service until after purchase is one way to offload excess inventory, but is it the best way? Associate Professor of Business Analytics Tingliang Huang co-authored “Opaque Selling and Inventory Management in Vertically Differentiated Markets,” forthcoming in Manufacturing & Service Operations Management. The article examines the profitability of opaque selling, and provides guidance for how to use the strategy in combination with inventory management to maximize returns.

Assistant Professor of Management and Organization Suntae Kim

Entrepreneurship can stimulate local economies—even depressed ones like Detroit— but the impact depends on how those businesses grow and scale. So argue Assistant Professor of Management and Organization Suntae Kim and co-author Anna Kim, in an article published this summer in the Academy of Management Journal titled “Going Viral or Growing Like an Oak Tree? Towards Sustainable Local Development through Entrepreneurship.” In it, they challenge the standard startup strategy of raising fast capital and growing rapidly—an approach they say doesn’t serve economically challenged areas in the same way it has Silicon Valley—and suggest that local developers looking to revitalize impoverished locales change up the pace for new ventures.

Alicia Munnell has recently authored or co-authored articles in publications ranging from the Journal of Pension Economics & Finance (“How to Pay for Social Security’s Missing Trust Fund?”) and the Journal of Risk and Insurance (“How best to annuitize defined contribution assets?”) to The Journal of the Economics of Ageing (“Are homeownership patterns stable enough to tap home equity?”). Munnell is the Peter F. Drucker Chair in Management Sciences, and director of Boston College’s Center for Retirement Research. She has also produced a raft of working papers and issues briefings in recent months, available at the center’s website.

What we consume has a lot to do with what we think others think about it, according to Associate Professor of Marketing and Hillenbrand Family Faculty Fellow Nailya Ordabayeva, who has published extensively on this and other aspects of luxury consumption this year. Her forthcoming article in Current Opinion in Psychology, titled “How social perceptions influence consumption for self, for others, and within the broader system,” divides consumption into three levels and unpacks how someone’s awareness of others’ perceptions can create tension. This follows an article published in the same journal in June 2021, titled “The psychology of luxury consumption,” in which Ordabayeva and two fellow researchers synthesize existing knowledge on the topic and advance a “tension-based framework” for continued study of luxury consumption. A few months earlier, in April, Ordabayeva also published “Status Pivoting” in the Journal of Consumer Research, which looks at how individuals alter how they project their social status to others when that status is under threat. And, in “How Politics Shapes Consumption Behavior,” a review of recent research published by the American Marketing Association, Ordabayeva and three co-authors make the case that “political polarization is spilling outside the voting booth and impacting the marketplace.”

Professor of Finance Jonathan Reuter

Does the size of a mutual fund have an impact on fund returns? Professor of Finance Jonathan Reuter, who is also a research associate at the National Bureau of Economic Research, examines this question in a paper titled “How Much Does Size Erode Mutual Fund Performance? A Regression Discontinuity Approach,” co-authored with Eric Zitzewitz of Dartmouth College. The authors state that “ratings significantly increase fund size, but that fund size has a negligible effect on fund returns.” The article was published this past September in the Review of Finance.

The Securities and Exchange Commission and shareholders of public companies alike have been helped by a 2004 policy shift that allowed the sun to shine on the agency’s previously private comment letters to companies, according to a new study by Professors Amy Hutton and Susan Shu (Accounting), along with Xin Zheng of the University of British Columbia. The scholars found that the greater transparency afforded by making the comment letters public motivated the agency to issue more, and more targeted, enforcement letters, specifically to firms with questionable accounting practices that eventually must restate their financial reports. Prior to the policy change, these letters were only available through time-consuming Freedom of Information Act (FOIA) requests. Their article is forthcoming from the Journal of Financial Economics.

How do you know when the price is right? What are some of the biases that drive decisions about pricing? In a new book, Associate Professor and Chairperson of Marketing Gerald Smith mixes the academic with the actionable to answer those and other questions for managers, entrepreneurs, and business owners in need of smarter pricing strategies. Released in October by Columbia University Press, the book is titled Getting Price Right: The Behavioral Economics of Profitable Pricing. Among other lessons, Smith pays attention to the soft skills of pricing (such as pricing strategy and “nudging”) as well as the hard skills (including value estimation and financial modeling).

Together with Charles deGrazia (Léonard de Vinci Pôle Universitaire) and Nicholas Pairolero (U.S. Patent & Trademark Office), Assistant Professor Mike H.M. Teodorescu (Information Systems) studies how patent-office incentives and other practices “affect the innovation ecosystem.” Their findings, in an article titled “Examination incentives, learning, and patent office outcomes: The use of examiner’s amendments at the USPTO,” will be published in Research Policy. Among the highlights: “We identify a previously unstudied patent examination negotiating tool at the USPTO called the examiner’s amendment,” which allows patent examiners to improve the efficiency of the patent system. In September, Teodorescu also delivered a co-written paper, “Machine Learning Fairness is Computationally Difficult and Algorithmically Unsatisfactorily Solved,” at the IEEE High Performance Extreme Computing Conference, organized by MIT’s Lincoln Laboratory. Also, Teodorescu and his Information Systems colleague Gerald C. Kane proposed that some measure of human oversight is necessary for any decision-making process that relies on machine learning. They refer to such oversight as “augmentation.” Their article, “Failures of Fairness in Automation Require a Deeper Understanding of Human-ML Augmentation,” appeared in the September edition of MIS Quarterly as part of a special issue on “Managing AI.” In it, the authors propose that organizations add humans to the equation according to where the final decision is made—human or machine—and the complexity of the fairness criteria underpinning the ML system.

Assistant Professor of Business Analytics Lai Wei

Assistant Professor Lai Wei (Business Analytics) co-authored a paper in Operations Research titled “On a Deterministic Approximation of Inventory Systems with Sequential Service-Level Constraints,” together with Stefanus Jasin of the University of Michigan and Linwei Xin of the University of Chicago. Wei and Jasin, as well as Roman Kapuscinski of the University of Michigan, have also collaborated on “Shipping Consolidation Across Two Warehouses with Delivery Deadline and Expedited Options for E-commerce and Omni-channel Retailers,” published in October in Manufacturing & Service Operations Management.

Online surveys are a common way to gather customer feedback, and social media platforms provide a seemingly ideal means of encouraging participation among connected users. Yet, survey respondents tend to be more moderate (and perhaps less honest) in the answers they give when they are highly aware that other people are filling out the same survey, according to new research from Associate Professor of Marketing Min Zhao and two colleagues. Their article, “Salient knowledge that others are also evaluating reduces judgment extremity,” was published in the Journal of the Academy of Marketing Science in September. Zhao also co-authored an article in Genes that demonstrates how, in a clinical setting, a patient’s willingness to undergo genetic testing to determine predisposition for serious diseases can be influenced by how these tests are presented.

Assistant Professor of Finance Simcha Barkai

Every year, workers lose wages because of corporate concentration, calling into question the reality of the free market. A New York Times opinion essay quoted research from Assistant Professor of Finance Simcha Barkai, which shows corporate concentration costs “about $14,000 a year in lost wages for the typical worker.” The concentration of jobs within large cities and among fewer large companies means the competition for workers’ labor is shrinking and fails to drive wages up. Thus, workers are “chronically underpaid,” a problem that has only intensified as organized labor has weakened over the past several decades.

Startups in Massachusetts attracted $17.4 billion in the first six months of this year—surpassing funding from all of 2020 and breaking all-time annual records. Professor of Finance Thomas Chemmanur told The Boston Globe that venture capital firms have invested in green tech, biotech, and software, including cybersecurity. But Chemmanur warns that the trend’s momentum could come to a halt. “I suspect VC investment will cool down if the IPO market cools down,” he said. “There is a strong connection between the two.”

Can consumers predict inflation by shopping at the grocery store? An InvestorPlace article quotes research from Assistant Professor of Finance Francesco D’Acunto to argue that “consumers know better than the Fed” when it comes to inflation. D’Acunto has shown that consumers often base their inflation perceptions on the price changes they see day to day, specifically while grocery shopping. Yet most official economic measures of inflation do not include food and energy prices, which can lead policymakers to “find themselves basing policy on assumptions that are totally off,” D’Acunto says. Because the government and economists consider food and energy price inflation to be “volatile,” consumers will be faced with inflation policy that does not reflect the rising prices seen in their day-to-day lives.

Senior Lecturer in Marketing John Fisher

Boston is a hub for footwear companies, with Reebok and New Balance already making their home there, and a recent surge of startups has followed the pandemic. Senior Lecturer in Marketing John Fisher, former CEO of the shoe company Saucony, told The Boston Globe that something big has changed for new shoemakers entering the business: it takes fewer people. He said these new companies may have employees who travel to manufacturing sites abroad to monitor the quality of production, “but the numbers of people they employ are dramatically down” from the hundreds who worked for his family in the 20th century, when his great-grandfather founded Saucony. The footwear industry has evolved since then, and will continue to adapt to Internet-driven shopping habits and patterns.

Associate Professor of Finance Vyacheslav (Slava) Fos appeared on The Deal’s “Activist Investing Today” podcast to speak about the corporate practice of disclosing record dates for voting securities after the date has already passed. Fos had co-authored a paper with fellow Carroll School Professor of Finance Clifford G. Holderness on the topic, titled “The Distribution of Voting Rights to Shareholders.” The article suggests this practice leaves retail investors and shareholders, who may want to influence the result of a contested situation, in the dark. On the podcast, Fos mentioned that state and federal regulations regarding record date obligations are at odds, so it is unlikely that the late-disclosure practice will go away any time soon. Additional research by Fos, on C-level executive teams “increasingly clustering with each other on the basis of political party,” was also cited in a Chicago Booth Review article. According to Fos and co-authors, although boardrooms may be diversifying their ranks with women and executives of color, the political affiliations of C-suite teams are becoming more homogenous.

As workers exit the throes of the pandemic and gradually return to the office (or don’t return at all), they must forge a new balance between work and life. Brad Harrington, executive director of the Boston College Center for Work and Family (CWF) and associate research professor, has spoken frequently about this transition. “I think this is an inflection point in the sense that more organizations will work towards making hybrid working an option, and it only happened because they have been forced into this situation,” he told CNN. “A lot of them were shocked and pleasantly surprised at how well it worked.” Harrington also gave a virtual lecture for WGBH titled “The End Of The Office: How Will The Pandemic Affect Your Work, Life, Home?” In May, BC Magazine interviewed Harrington about the future of work for a podcast episode. Even beyond the pandemic, balancing work and home lives can be a difficult skill to learn. The Harvard Business Review referenced Harrington’s research on the need for companies to provide support systems like affinity groups that help new dads navigate their roles as working fathers. Harrington also spoke to The 19th about working dads pushing for paid parental leave, saying, “I don’t think there’s any policy that organizations or the government could offer that would be more conspicuously pro–gender equality than parental leave.”

Is a “free” credit card really free? The answer, says Senior Finance Lecturer Drew Hession-Kunz, is complicated. A consumer pays a retailer with a credit card, but the consumer does not pay for the purchase until it is time to pay their credit card bill. In the meantime, a credit card company extends credit (essentially giving a small loan) to the retailer, who must pay about two percent to cover this loan. The charge likely gets passed on to the consumer—so really, the “free” credit card is not entirely free. Hession-Kunz answered these and other questions about free credit cards in a Q&A with WalletHub.com.

In October of last year, The Wall Street Journal began running excerpts from Professor Gerald Kane’s co-authored book, The Transformation Myth: Leading Your Organization through Uncertain Times (The MIT Press), and the series is still running one year and 18 installments later. One of those installments involved an interview with a Boston College parent, on how people-centered principles and adaptive innovation led Beam Suntory, a leading premium spirits provider, through the pandemic. Among other changes, the company dedicated an entire factory in Kentucky to producing hand sanitizer and created more e-commerce services to reach consumers, while keeping all of their employees during the pandemic. “We prioritized our people and their safety and capitalized on new trends when things were moving very, very quickly,” said president and CEO Albert Baladi, P ’19. In September, the MIT Sloan Management Review adapted a chapter of the book (under the title, “The Digital Superpowers You Need to Thrive”) for its September 28 edition. Kane also spoke on The Financial Brand’s “Banking Transformed” podcast about the interviews and research he conducted for The Transformation Myth, and how financial institutions can use disruptions—such as the pandemic—as opportunities to innovate.

Assistant Professor of Finance Leonard Kostovetsky

The Blindfolded Chimpanzee is a new blog authored by Assistant Professor of Finance Leonard Kostovetsky about trends in finance and investing—with, as Kostovetsky says, “an academic flavor.” Wall Street Journal columnist Jason Zweig mentioned a Blindfolded Chimpanzee post about specialized exchange-traded funds in one of his weekly newsletter installments, under a list of “some of the best things I found over the past week outside The Wall Street Journal.” In this post, The Blindfolded Chimpanzee advises readers to stay away from “style investing,” or investing in themed ETFs that have become more specialized and trend-influenced over time, making them more risky. Kostovetsky was also quoted in The Wall Street Journal as saying Bitcoin is “just like buying a lottery ticket,” rather than being an inflation hedge. Since mid-April, the WSJ said, the cryptocurrency has lost around half its value.

PYMNTS.com interviewed Assistant Professor of Information Systems Zhuoxin (Allen) Li about the impact of third-party food delivery services on independent restaurants’ profits, and a fee cap as a possible solution. A fee cap that limits how much of a commission delivery services can take from small restaurants—which New York and San Francisco have already enacted—may not be the answer. Li’s research shows that, in an effort to work around fee caps and maximize their commission, delivery services end up steering customers to big chains, which are exempt from fee caps, at the expense of independent restaurants. He says that tiered pricing plans would be the best-case scenario, but there is not a win-win for both restaurants and delivery services.

Boston College Center for Retirement Research and Peter F. Drucker Chair in Management Sciences Alicia Munnell

Inflation and retirement have been at the forefront of consumers’ minds, and not just because of the pandemic. Director of the Boston College Center for Retirement Research and Peter F. Drucker Chair in Management Sciences Alicia Munnell spoke with several news organizations about these problems and some possible solutions. A Forbes article about America’s retirement crisis noted that there aren’t enough taxpayers to fund Social Security benefits, in part because of the declining fertility rate; Munnell pointed out that one solution is to increase the number of immigrants allowed into the United States. She also talked to news outlets about inflation and its impact on retirees, and how COVID has affected life expectancy—especially for people of color. Munnell was also quoted by The New York Times, The Boston Globe, Marketwatch, Bloomberg Tax, The Wall Street Journal, Marketplace, and Barron’s, among others.

Professor of Information Systems Sam Ransbotham

Professor of Information Systems Sam Ransbotham studied how corporations have adopted artificial intelligence during the pandemic. Because employers are struggling to find enough workers, he told WIRED, automation technology is being used mostly to replace specific tasks, not necessarily employees. Still, some businesses are replacing employees with AI and not looking back. For example, fast food restaurants have been using automated technology to take orders—and the automated cashiers have been more successful than their human counterparts at upselling customers to add fries or a drink to their order. The article also notes that women are more likely to experience the negative effects of job automation than men. Ransbotham’s research was also covered in the MIT Sloan Management Review, as part of the recently released global report, “The Cultural Benefits of Artificial Intelligence in the Enterprise.” The study, which Ransbotham co-authored along with experts from Boston Consulting Group, is a longitudinal examination of cross-industry AI adoption. The report identifies a wide range of AI-related cultural benefits at both the team and organizational levels.

Working remotely with friends strikes a happy medium between solitary remote work and returning to the office. Assistant Professor of Management and Organization Beth Schinoff told The Seattle Times that when you work with a friend, “there’s a glimmer of hope sitting next to you.” Schinoff listed the benefits of working remotely with a friend: it creates a positive environment, it can increase productivity, and it can deepen friendships by experiencing a new part of life together. On the flip side, she said, this arrangement may have drawbacks—for one thing, working in the same space with someone you want to talk to, and spend time with, can be distracting. Schinoff offered her advice for successful remote coworking with friends, saying the first step is to establish guidelines and boundaries ahead of time.

Associate Professor of Management and Organization Mohan Subramaniam

In September, the Harvard Business Review ran an article by Associate Professor of Management and Organization Mohan Subramaniam exploring themes in his forthcoming book, The Future of Competitive Strategy: Unleashing the Power of Data and Digital Ecosystems, to be published by The MIT Press in the fall of 2022. Subramaniam outlines four distinct tiers of digital transformation: operational efficiencies, advanced operational efficiencies, data-driven services from value chains, and data-driven services from digital platforms. Each tier brings companies beyond making digital investments and changes only when necessary, and pushes them to get all they can out of digital technologies by implementing these specific strategies.

Stanford Business Insights cited research by Assistant Professor of Accounting Benjamin Yost about how the tone of disclosures made by an acquiring company (doing the buying) influences the stock price of the target company (being bought). Yost and his co-authors studied 381 all-cash mergers that took place between 2000 and 2017. Their findings, published in the Journal of Accounting Research, suggest an acquiring company may issue press releases designed to cast doubt on the future profitability of the target company, thereby depressing the stock price of the target company. During merger negotiations, acquiring companies took a more positive or negative tone compared to the period before negotiations if it was likely to lower the stock price of the target company. That research also made news in a story from MIT Sloan on “3 Hidden Forces Driving the M&A Market.” Additionally, a summary of related research by Yost and co-authors appeared on Duke University’s FinReg Blog. The working paper explores the role of litigation risk in the "fairness opinions" that provide comparisons to peer firms as part of the M&A process.

Assistant Professor of Management and Organization Curtis Chan

Assistant Professor of Management and Organization Curtis Chan received the ONE-SIM Outreach Award, given by the Organizations and the Natural Environment and Social Issues in Management divisions of the Academy of Management. Chan accepted the award alongside a co-author for their paper, “A Self-Fulfilling Cycle of Coercive Surveillance: Workers’ Invisibility Practices and Managerial Justification,” published in Organization Science, which explores how workers’ and managers’ beliefs about workplace oversight inadvertently reinforce one another. This creates a cycle of distrust that the authors say explains increased use of surveillance technology by organizations in recent decades.

At the INFORMS annual meeting in Anaheim, California, Professor of Business Analytics and Michael A. Gooch Family Faculty Fellow Jiří Chod and co-authors were announced as winners of the 2021 MSOM SIG Best Paper Award. Their winning article, “On the Financing Benefits of Supply Chain Transparency and Blockchain Adoption,” appeared in Management Science. Moreover, in another issue of that journal, a paper of Chod’s, “A Theory of ICOs: Diversification, Agency, and Information Asymmetry,” was featured as the lead article.

Assistant Professor of Finance Francesco D’Acunto, along with two co-authors, received the 2021 PBCSF Award for Best Paper in Fintech at the Western Finance Association conference, held in June. Their winning paper, “How Costly are Cultural Biases? Evidence from FinTech,” reveals the pervasive effects of cultural biases on investment performance.

Accounting Ph.D. candidates Jared Flake and Mark Piorkowski both received 2021 Financial Accounting and Reporting Section (FARS) Excellence in Reviewing Awards, recognizing their outstanding contributions in reviewing papers during the selection process for both the FARS Midyear Meeting and AAA Annual Meeting.

Associate Professor of Marketing Henrik Hagtvedt received a Journal of Consumer Research Outstanding Reviewer Award for providing “constructive, benevolent, and punctual reviews during the previous year.”

Associate Professor of Business Analytics Tingliang Huang was appointed as an associate editor of Naval Research Logistics.

Assistant Professor of Marketing Megan Hunter

Assistant Professor of Marketing Megan Hunter received the Financial Literacy Research Award for her co-authored paper, “Can Facing the Truth Improve Outcomes? Effects of Information in Consumer Finance,” at the 2021 Cherry Blossom Financial Education Institute conference. Her research explores how and when a consumer’s financial health is affected by their awareness of their own credit score.

Assistant Professor of Management and Organization Suntae Kim was a finalist for the 2021 Bradford Osborne Research Award for his paper, “Frame Restructuration: The Making of an Alternative Business Incubator Amid Detroit’s Crisis.” The paper, which was published in Administrative Science Quarterly earlier this year, explored cognitive frame restructuring through an ethnographic study of a Detroit business incubator throughout the COVID-19 pandemic.

Accenture Professor of Marketing Katherine N. Lemon and a co-author were named winners of the 2021 Sheth Foundation/Journal of Marketing Award for their paper, “Understanding Customer Experience Throughout the Customer Journey,” published in the Journal of Marketing in 2016. Winners are selected for their “long-term contributions to the field of marketing,” and articles must be at least five years past their publication date to be considered. Lemon also received SAGE Publications’ 10-Year Impact Award recognizing a 2010 paper she co-authored titled “Customer Engagement Behavior: Theoretical Foundations and Research Directions.” The honor is given to the three most cited articles across all of SAGE’s academic journals in the past 10 years.

Assistant Professor of Accounting Miao Liu took home the American Accounting Association’s 2021 Financial Accounting and Reporting Section (FARS) Award for best dissertation. Liu’s 2019 dissertation, “Assessing Human Information Processing in Lending Decisions: A Machine Learning Approach,” explores how artificial intelligence can be used to assess human information processing behavior in banking. While loan officers tend to overreact to information such as negative jumps in borrowers’ cash flows, they also derive useful “soft information.” They do so by interacting with borrowers, an ability unmatched by AI, according to Liu’s finding.

Associate Professor of Marketing and Hillenbrand Family Faculty Fellow Nailya Ordabayeva

Associate Professor of Marketing and Hillenbrand Family Faculty Fellow Nailya Ordabayeva was appointed as a Journal of Consumer Psychology associate editor. Additionally, her 2021 paper in the Journal of Consumer Research, “Status Pivoting,” received the Journal of Consumer Research Ferber Award Honorable Mention. Ordabayeva also received a 2021 Outstanding Reviewer Award from the International Journal of Research in Marketing.

Associate Professor of Finance Jonathan Reuter was appointed associate editor of the Journal of Financial Economics.

Associate Professor of Management and Organization Metin Sengul

Associate Professor of Management and Organization Metin Sengul was selected as one of Poets & Quants’ “Favorite MBA Professors of The Class Of 2021” because of his “incredibly engaging, effective, and exacting” teaching style. His students felt challenged daily to “show up to Sengul’s class prepared and sharp-witted.” The list, which is based on interviews with M.B.A. students and recent M.B.A. alums from across the country, brings together students’ most memorable professors from a variety of disciplines.