By Sean Hennessey | Chronicle Staff

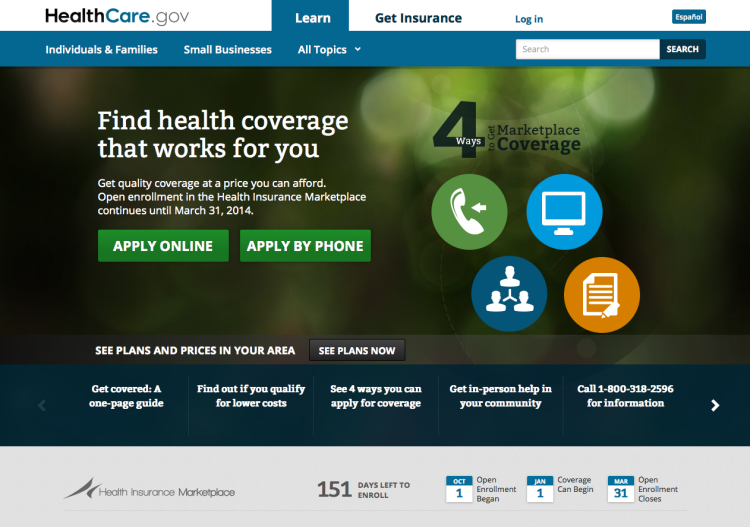

With the Affordable Care Act continuing to serve as a political lightning rod, two Boston College Law experts on the ACA say initial problems are to be expected, and that there are valid reasons why many are having their health insurance cancelled.

“There are real problems with Healthcare.gov, but they are by no means insurmountable,“ says Professor Mary Ann Chirba. “In fact, given the complexity of what is being launched, it is not surprising that there have been problems in achieving lift-off.”

Chirba and adjunct faculty member Alice Noble have read all 907 pages of the statute line by line, and are the authors of the new book, Healthcare Reform: Law and Practice.

“It is not time to push the panic button,” says Noble. “Designing the exchange was complicated to begin with for several reasons, including the lack of clarity about how many states would run their own exchanges, how many would participate in the ACA’s Medicaid expansion program and how many insurers would compete in a given state or region with further variations in the number, kinds, and costs of available plans.”

Many are having their health insurance cancelled, despite assurances over the years from President Obama, who often said: “If you like your health plan, you can keep your health plan.”

“If President Obama had to do it over again, he may have said it differently,” says Noble. “Certain plans that don’t meet certain criteria will no longer be allowed to be sold, but the statement underscores the fact that we are not completely deconstructing the health insurance system. For many, it’s going to work generally the way it has.”

The two point out that the exchanges are intended to spur functioning insurance markets in every state so that competition among insurers can give consumers more choices at better prices. For this to work, however, consumers must be able to “shop” and evaluate the costs and benefits of different plans.

“A system needs to have good decision support tools for those new to buying or even having health insurance so that not only premiums but deductibles and co-payments are properly included into a consumer’s monthly costs, which can vary by region and applicant age,” says Chirba. “This goes to system design, not to the need for the system to begin with.”