Gergana Nenkov

05-20-2025

The professor of marketing was named an associate editor of the recently established Journal of Sustainable Marketing.

Cheng (Jason) Jiang

05-19-2025

Research by assistant professor of the practice in finance Cheng (Jason) Jiang found that narcissistic CEOs are prone to riskier, less profitable insider trades, driven by their inflated egos. Featured in Financial Times, the study highlights how unchecked ego in leadership can have significant hidden costs for companies.

Mary Ellen Carter

05-18-2025

Executives typically forfeit their right to retain unvested shares when they leave a company to enter government service, but recently confirmed FBI director Kash Patel hasn’t made any indications that he will follow this precedent. In a Wall Street Journal article Joseph L. Sweeney Chair and professor of accounting Mary Ellen Carter explained that Patel will continue receiving income from Elite Depot, the parent company of Chinese fashion retailer Shein—a move that has raised concerns about potential conflicts of interest.

Andrey and Nadya Malenko

05-13-2025

Both professors in the Seidner Department of Finance, Hillenbrand Family Faculty Fellow Andrey Malenko and Wargo Family Faculty Fellow Nadya Malenko won the 2024 Best Paper in Corporate Finance Award from the Society for Financial Studies for their paper titled "Voting Choice."

"Human Capital Acquisition in Response to Data Breaches"

05-12-2025

Sebastian Steffen, Assistant Professor of Business Analytics

MIS Quarterly

Co-authors:

Sarah H. Bana, Chapman University

Erik Brynjolfsson, Stanford University

Wang Jin, Stanford University

Xiupeng Wang, Northeastern University

Given the rise in the frequency and cost of data security threats, it is critical to understand whether and how companies strategically adapt their operational workforce in response to data breaches. We study hiring in the aftermath of data breaches by combining information on data breach events with detailed firm-level job posting data. Using a staggered difference-in-differences approach, we show that breached firms significantly increase their demand for cybersecurity workers. Furthermore, firms’ responses to data breaches extend to promptly recruiting public relations personnel—an act aimed at managing trust and alleviating negative publicity—often ahead of cybersecurity hires. Following a breach, the likelihood of firms posting a cybersecurity job rises by approximately two percentage points, which translates to an average willingness to spend an additional $61,961 in annual wages on cybersecurity, public relations, and legal workers. While these hiring adjustments are small for affected firms, they represent a large potential impact of over $300 million on the overall economy. Our findings underscore the vital role of human capital investments in shaping firms’ cyber defenses and provide a valuable roadmap for managers and firms navigating cyberthreats in an increasingly digital age.

Sam Ransbotham

05-12-2025

A new study by AI company Anthropic showed that only 1 in 25 jobs are being significantly impacted by AI taking over certain tasks. Sam Ransbotham, the David J. Mastrocola Dean's Faculty Fellow and professor of business analytics, shared his expertise on the issue, saying in The Boston Globe, "There will be jobs that go away, and there will be people that become more productive. What gets harder is figuring out exactly who and where."

"Media Exposure and Corporate Labor Investment Decisions"

05-11-2025

Susan Shu, Kathleen Fruin Corbet Faculty Fellow and Professor of Accounting, and Alvis Lo, Associate Professor of Accounting

The Accounting Review

Co-authors:

Vishal P. Baloria, University of Connecticut

We examine whether the media can act as a friction that hampers the efficiency of corporate labor investment, a decision that attracts significant media attention. We develop a new measure of media exposure that takes into account the circulation and geographic proximity of a comprehensive set of media outlets. We show media exposure leads to greater labor investment inefficiency. Closer examination reveals that media exposure is associated with firms underhiring, but not underfiring. This underinvestment in labor by managers helps avoid future layoffs but is inefficient in that firms are left understaffed relative to their economic fundamentals. Further, we find that managers’ concerns about their personal reputation, but not the firm’s reputation, primarily drive our results. Our findings illustrate that the media can serve as a friction for, in addition to being a facilitator or monitor of, corporate labor investment decisions.

"Recycle Right: How to Decrease Recycling Contamination with Informational Point-of-Disposal Signage"

02-06-2025

Gergana Nenkov, Associate Professor of Marketing and Megan Hunter, Assistant Professor of Marketing

Journal of the Academy of Marketing Science

Co-authors:

Aylin Cakanlar, Stockholm School of Economics

Plastic pollution represents a grand challenge facing society, yet the amount of plastic being recycled is only about 5%. This recycling crisis has intensified with the growing problem of recycling contamination (i.e., incorrect placement of unrecyclable materials in recycling receptacles). This research investigates the potential for informational point-of-disposal recycling signage to decrease recycling contamination. In a longitudinal field study and three experiments, the authors demonstrate that providing schema-congruent prescriptive information (“Recycle these items”) does not reduce recycling contamination and may inadvertently lead to over-recycling. In contrast, the presence of proscriptive information that is moderately incongruent with established schemas (“Do not recycle these items”) prompts more effortful, piecemeal processing. This encourages individuals to integrate the information into their recycling decisions, diminishing their dependence on pre-existing beliefs and expectations regarding recycling and, consequently, lowering contamination rates. Recycling expertise is found to moderate the effects of point-of-disposal recycling signage. By examining such nuanced recycling communication strategies, this research aims to shift the conversation from “recycle more” to “recycle right.”

Ronnie Sadka and Miao Liu

02-04-2025

Two Carroll School professors were among the recipients of the 2024 Research Prize from the IQAM Research Institute. The Haub Family Professor of Finance and Senior Associate Dean for Faculty Ronnie Sadka and colleagues received the first place prize for their paper titled "Narrative Attention Pricing." Assistant professor of accounting Miao Liu and colleagues won the second place prize for their paper titled "Hedging Climate Change Risk: A Real-time Market Attention Approach."

Thomas J. Chemmanur

02-04-2025

In an article for The Boston Globe, professor of finance Thomas J. Chemmanur addressed expectations that the Trump administration will scale back enforcement of antitrust laws. He noted that strong enforcement tends to benefit startups “by encouraging greater competition in the tech industry.”

"Demand-Side and Supply-Side Constraints in the Market for Financial Advice"

02-03-2025

Jonathan Reuter, Associate Professor of Finance

Annual Review of Financial Economics

Co-authors:

Antoinette Schoar, MIT

In this review, we argue that access to financial advice and the quality of this advice is shaped by a broad array of demand-side and supply-side constraints. While the literature has predominantly focused on conflicts of interest between advisors and clients, we highlight that the transaction costs of providing advice, mistaken beliefs on the demand side or supply side, and other factors can have equally detrimental effects on the quality of and access to advice. Moreover, these factors affect how researchers should assess the impact of financial advice across heterogeneous groups of households. While households with low levels of financial literacy are more likely to benefit from advice—potentially including conflicted advice—they are also the least likely to detect misconduct and perhaps the least likely to understand the value of paying for advice. Regulators should consider not only how reg- ulation changes the quality of advice but also the fraction of households who are able to receive it and how different groups would have invested without any advice. Financial innovation has the potential to provide customized advice at low cost but also to embed conflicts of interest in algorithms that are opaque to households and regulators.

Alicia Munnell

02-03-2025

After more than 25 years as the director of the Boston College Center for Retirement Research, Alicia Munnell started her own retirement at the end of 2024. Before she left, the Peter F. Drucker Chair in Management Sciences spoke with publications including The Wall Street Journal and The Boston Globe about her successful career and offered lasting advice about the future of retirement. “I’m very proud of this center," she told the New York Times. “We have great people and really good academics who really care.”

"Complexity of CEO Compensation Packages"

02-01-2025

Mary Ellen Carter, Professor of Accounting, Joseph L. Sweeney Chair

Journal of Accounting and Economics

Co-authors:

Ana Albuquerque, Boston University

Zhe Guo, Fordham University

Luann Lynch, University of Virginia

This paper examines complexity in CEO compensation contracts. We develop a measure of compensation complexity and provide empirical evidence that complexity has increased substantially over time. We document that complexity results not only from factors reflecting efficient contracting, but also from external pressures from compensation consultants, institutional investors, proxy advisors, and attempts to benchmark to peers, with these external factors having greater impact in more recent years. Examining consequences of contract complexity, we find an association with lower future firm performance that is related to the influence of external factors on compensation design. We further find this relation is partially mitigated when a contract's performance metrics are more highly correlated, consistent with information processing costs hampering decision-making. Collectively, these findings confirm concerns raised by investors and the media regarding compensation complexity and can inform boards in their design of CEO pay packages.

Sam Ransbotham

02-01-2025

Sam Ransbotham, the David J. Mastrocola Dean's Faculty Fellow and professor of business analytics, has been quoted in publications including The Boston Globe, Fortune Magazine, and CBS Boston about all things artificial intelligence. In the 2024 AI and Business Strategy report from the MIT Sloan Management Review, Ransbotham and colleagues explored the rise of generative AI and highlighted how organizations that integrate organizational learning with AI are better equipped to navigate uncertainty.

Lian Fen Lee

01-28-2025

The associate professor of accounting was recognized as an outstanding reviewer by Contemporary Accounting Research and was selected to serve as a member of the Accounting Horizons editorial board.

Jamie Ladge

10-05-2024

The professor of management and organization and colleagues were named distinguished winners of the 2024 Responsible Research in Management Award by Responsible Research in Business Management. The paper, titled "Sensemaking through the storm: How postpartum depression shapes personal work–family narratives,” was published in the Journal of Applied Psychology.

Samuel Hartzmark

10-03-2024

Samuel Hartzmark, a professor of finance, was quoted in a Fortune Magazine article about Gen Z investors seeking financial guidance from non-traditional sources, such as astrology and tarot cards, when day-trading. The Hillenbrand Family Faculty Fellow warned against falling for such fads when it comes to finances and explained that “the illusion of control” was likely why many people feel drawn to the unusual investment strategies.

John Fisher

09-19-2024

In a Boston Globe article, John Fisher weighed in on why the recently announced team name for Boston’s new women’s soccer club was met with an underwhelming response from fans, saying that it may be due to team owners overlooking key branding practices. The Marketing Department senior lecturer was also featured on an episode of the American Marketing Association’s podcast, Marketing / And, where he discussed his thoughts on the importance of CMOs and the rise of shoes as entertainment.

"Internalizing Peer Firm Product Market Concerns: Supply Chain Relations and M&A Activity"

09-05-2024

Benjamin Yost, Associate Professor of Accounting, Clark Family Faculty Fellow

Journal of Accounting Research

Co-authors:

Farzana Afrin, California State University

Jinhwan Kim, Stanford University

Sugata Roychowdhury, Northwestern University

"We explore whether firms internalize the product market concerns of their economically linked peers by examining merger and acquisition decisions in the context of customer–supplier relations. Given the extensive transfer of capital, knowledge, and information between merging parties, we hypothesize that customers’ competition concerns discourage their suppliers from engaging in vertically conflicted transactions (i.e., acquisitions of their customers’ rivals or suppliers to those rivals). Consistent with our hypothesis, we find that suppliers are less likely to engage in such transactions when their customers are subject to higher product market competition. Moreover, the effect is more pronounced when suppliers and customers have greater relationship-specific investments and when customers face heightened proprietary information concerns. Using plausibly exogenous variation in common ownership between customers and their rivals as a shock to customers’ competition concerns, we conclude that the link between customers’ competition concerns and supplier acquisitions is likely causal. Our findings suggest that firms alter their investment and strategic decisions in response to the product market competition concerns of their economically related peers."

Hanyi (Livia) Yi

09-05-2024

The assistant professor of finance and colleagues received the Best Paper Award at the 2024 Fintech and Financial Institutions Research Conference for their paper, “Algorithmic Underwriting in High Risk Mortgage Markets.”

"Creating Controversy in Proxy Voting Advice"

09-04-2024

Andrey Malenko, Professor of Finance and Hillenbrand Family Faculty Fellow, and Nadya Malenko, Professor of Finance and Wargo Family Faculty Fellow

Journal of Finance

Co-author:

Chester Spatt, Carnegie Melon University

"We study the effectiveness of shareholder engagement, that is, shareholders communicating their views to management. When shareholders and management have different beliefs, each shareholder engages more effectively when other shareholders engage as well. A limited shareholder base can thus prevent effective engagement. However, a limited shareholder base naturally arises under heterogeneous beliefs because investors who most disagree with management do not become shareholders. Passive funds, which own the firm regardless of their beliefs, can counteract these effects and improve engagement. When shareholders' and management's preferences are strongly misaligned, shareholders' engagement decisions become substitutes and the role of ownership structure declines."

Dmitry Mitrofanov and Do Yoon Kim

09-02-2024

Assistant professors of business analytics Do Yoon Kim and Dmitry Mitrofanov offered valuable insights on how retailers can tackle out-of-stock product issues, enhance customer satisfaction, and boost their bottom line in today’s competitive online retail market in an article for Harvard Business Review.

"Devoted but Disconnected: Managing Role Conflict Through Interactional Control"

08-05-2024

Vanessa Conzon, Assistant Professor of Management and Organization

Organization Science

Co-author:

Ruthanne Huising, Essec Business School

"The ideal worker is represented as constantly available for work. However, an increasing number and variety of workers experience conflict between work and family demands. Research has identified numerous practices to manage this conflict with positive implications for non-work relationships, but the implications of these practices for work relationships remain unclear. How do efforts to manage role conflict affect workplace relationships? To examine this question, we draw on ethnographic data from 72 STEM workers across three organizations. We find that workers who experienced role conflict interpreted interactions in the workplace—often unpredictable in timing, frequency, and length—as a threat to fulfilling both their work and family roles on a daily basis. Thus, they controlled work interactions to make time for both work and non-work roles. However, interactional control limited their sense of workplace belonging and opportunities for resource exchange. In contrast, workers who did not experience daily role conflict encouraged interactions, allowing these encounters to expand across time. As a result, their work extended into evenings and weekends, and they experienced a sense of belonging and more regular resource exchange. We identify how interactional control practices manage role conflict but limit the development of workplace relationships. We also expand the repertoire of how devotion to work can be performed, identifying the occupied worker who expresses devotion through focused and efficient work and interactions rather than availability for work and interactions."

Read the Article

Michael Pratt

06-10-2024

The professor of management and organization was awarded the 2024 Distinguished Service Award from the Academy of Management’s Managerial and Organizational Cognition Division. The award was in recognition of Pratt’s 12 years of service with the professional association’s Reviewing in the Rough professional development workshop.

A Hero's Journey

12-04-2023

Benjamin Rogers and colleagues say that viewing your life as a “Hero’s Journey” could add meaning to it. The assistant professor of management and organization has been researching the effect that stories have on our lives and catching the attention of publications including Nautilus Magazine, Inc. Magazine, and Forbes.

The Coughlin Distinguished Teaching Award

10-01-2022

O’Connor Family Professor of Management and Organization Michael Pratt was recognized with the Coughlin Distinguished Teaching Award by the Carroll School.

Populating the Top 20

09-21-2022

The Boston College Carroll School of Management has continued its strong showing in national rankings—with no fewer than six academic departments and programs landing in the top 20 of their disciplines. That's according to U.S. News & World Report's annual survey of undergraduate schools of management in the United States. In the new compilation, the Carroll School also held steady at no. 30 overall, out of 516 participating business schools.

.jpg)

Low on Stock? Let Your Customers Know

09-05-2022

New research by Assistant Professor of Business Analytics Dimitry Mitrofanov and co-author Benjamin Knight featured in Harvard Business Review revealed that customers using online grocery delivery services, like Instacart, were overall more satisfied with their experiences and spent more money when they received a warning that an item they had selected was “likely out of stock.”

Excellence in Refereeing

09-01-2022

Accounting Department Chair and Professor Mark Bradshaw won the Outstanding Discussion Award from the Financial Accounting and Reporting Section (FARS) for his discussion on the subject of attributes and use of financial analyst outputs at the 2022 FARS Midyear Meeting. In addition, he received a 2022 Referee of the Year award from the Journal of Accounting Research, where he was previously honored for his “Excellence in Refereeing” in 2021. These recognitions highlight his work as an expert in the field to review, or “referee,” research submitted to the journal.

The Truth About Performance Goals

07-29-2022

Can tying CEO compensation to performance goals make contracts too complicated and ultimately lead to lower firm performance? Research from Joseph L. Sweeney Chair and Accounting Professor Mary Ellen Carter says yes. Her working paper, “Complexity of CEO Compensation Packages,” co-authored by Ana M. Albuquerque and Zhe (Michael) Guo (both Boston University), and Luann J. Lynch (University of Virginia), was featured on the Columbia Law School blog. Their findings were also highlighted by the Boston Business Journal.

Are the Sacrifices Required to be an “Ideal Worker” Worth it?

07-23-2022

Are the sacrifices it takes to be an “ideal worker” right now worth it? Research co-written by Management and Organization Assistant Professor Vanessa Conzon, and highlighted by The Gig Work Life, explores the tactics gig workers have used to protect themselves and their reputations during the pandemic.

Professor Appointed by President Biden to Emergency Board

07-17-2022

Professor of Business Law and Society David Twomey was named by President Biden to an emergency board helping to resolve disputes between freight rail carriers and their unions. An expert on employment and labor law, Twomey has previously served on similar boards.

Sensible and Sustainable

07-14-2022

Galligan Chair of Strategy and Professor of Management Sandra Waddock shared with Politico how during an economic downturn, sustainable practices might be a win for companies. Waddock, who is also a Carroll School Scholar of Corporate Responsibility, added that sustainability initiatives are often “sensible measures that actually save money for the firm.”

New Book by Professor Gerald Smith Wins Marketing Award

07-08-2022

The American Marketing Association honored Getting Price Right: The Behavioral Economics of Profitable Pricing, authored by Associate Professor of Marketing Gerald Smith, with the 2022 Leonard L. Berry Marketing Book Award. This award recognizes innovative ideas within recently published books that have made a significant impact on the field of marketing.

An Outstanding Article in Positive Organizational Scholarship

07-01-2022

Associate Professor of Management and Organization Judith Clair was honored, along with co-author Katina B. Sawyer (University of Arizona), with the 2022 Award for Outstanding Published Article in Positive Organizational Scholarship for their paper, “Hope Cultures in Organizations: Tackling the Grand Challenge of Commercial Sex Exploitation,” originally published in Administrative Science Quarterly. The award was presented by the Michigan Ross Center for Positive Organizations at the University of Michigan.

The Kathleen Christiansen Dissertation Award

06-30-2022

Assistant Professor of Management and Organization Vanessa Conzon received the Kathleen Christiansen Dissertation Award, co-sponsored by the Work and Family Researchers Network and the Society for Human Resource Management. Conzon was unanimously recommended by the award selection committee because of the “ambition of her dissertation work, its methodological strengths, as well as its contributions to theory and practice.” She was also recognized as a runner-up to the Louis Pondy Best Paper Dissertation Award and a finalist for the Industry Studies Association Dissertation Award.

Early Career Women in Finance Conference

06-24-2022

This year’s Early Career Women in Finance Conference, which took place in June, was co-organized by Assistant Professor of Finance Nancy Xu. The annual event celebrates research by women in finance by providing a forum for junior female faculty members to present their work.

Rent, or Everything Else?

06-08-2022

Newton Centre restaurant Ellana’s Kitchen closed after the landlord sold the property and the owners were unable to afford to buy the space for themselves. Small businesses almost always have to rent space, Business Law and Society Senior Lecturer Edward Chazen told The Boston Globe. If they tie up money in real estate, they lack the capital for other essential expenses like inventory and hiring workers.

Scholarly Influence in Organizational Studies

06-01-2022

The Administrative Science Quarterly Award for Scholarly Contribution, given to the paper published five years earlier that has subsequently had the greatest influence on the field of organization studies, was given to Assistant Professor of Management and Organization Curtis Chan and Michel Anteby (Boston University) for their paper, “Task Segregation as a Mechanism for Within-job Inequality: Women and Men of the Transportation Security Administration.”

Bess Rouse Named Associate Editor of the Academy of Management Journal

06-01-2022

Hillenbrand Family Faculty Fellow and Management and Organization Associate Professor Elizabeth (Bess) Rouse was appointed as an Associate Editor at the Academy of Management Journal.

An Outstanding Paper on Financial Markets

05-31-2022

The Federation of European Securities Exchanges (FESE) De la Vega Prize—awarded for an outstanding paper on financial markets—went to Samuel Hartzmark, Hillenbrand Family Faculty Fellow and Professor of Finance, and David Solomon, David J. Mastrocola Faculty Fellow and Professor of Finance, for their paper, “Predictable Price Pressure.”

Professor Vyacheslav Fos Wins Best Paper Award

05-27-2022

The Review of Asset Pricing Studies has bestowed its Best Paper Award on Hillenbrand Family Faculty Fellow and Finance Professor Vyacheslav (Slava) Fos and co-author Alex Chinco (Baruch College) for their paper “The Sound of Many Funds Rebalancing.”

The Big Ideas

05-13-2022

The Finance Conference returned in person to Boston College this spring, bringing together alums, students, and leaders from across industries. One attendee, Aaron Horne '17 shared that the annual event helps him “to not only be more informed in my job, but just as a person engaging with the world.” Hear firsthand from attendees about the day and the topics that stuck with them.

Making Real Estate Work for Everyone

04-12-2022

At a time when the housing crisis appears to be deepening in the United States, the Joseph E. Corcoran Center for Real Estate and Urban Action brought together undergraduate students around the country to tackle the issue of affordability at the center’s fourth annual case competition.

The Path Less Traveled

04-08-2022

What happens when we stop doubting that we belong in the spaces we inhabit? This question is at the heart of the “I Belong” speaker series presented by the Winston Center for Leadership and Ethics, which kicked off virtually in February. In the inaugural event, Christine Montenegro McGrath ‘87, H’21, a senior leader at Mondelēz International, shared stories of finding community in unexpected places.

Leading With Love

04-08-2022

Success isn't about simply making it to the top, says Brandon Fleming. From college dropout to Harvard educator, the acclaimed debate coach traced his personal journey for captivated students at the annual Brennan Symposium hosted by the Winston Center for Leadership and Ethics.

A Challenge for Business Schools

03-24-2022

Increasingly, the mass production model of management is sharing the stage with a new people-oriented paradigm, more attuned to the needs of workers, the environment, and society. Should management education simply trade in the old model for the new one? In this reflection, Dean Andy Boynton and a colleague take the long view—offering a both/and perspective.

Professor Jeff Cohen Honored with Distinguished Service in Auditing Award

03-24-2022

Professor of Accounting Jeffrey Cohen has been awarded the Distinguished Service in Auditing Award from the American Accounting Association (AAA). The AAA, where Cohen is an active member, is the largest community of accountants in academia.

Stuck in the Middle

03-19-2022

Marketing Senior Lecturer John Fisher commented to CNN about the decline of department store giant Kohl’s, which illustrates a broader downturn in the department store sector in recent years because of their market position in between discount brands and luxury stores. “It’s hard to be unique,” Fisher says. “I think Kohl’s is caught right now by death in the middle.”

Don't Get Stuck in "the Idea Phase"

03-15-2022

In late February, an eager group of students gathered roundtable-style for an Ask Me Anything talk with Riley Soward ‘18. The event took place in a light-filled conference room at the spacious quarters of the Edmund H. Shea Jr. Center for Entrepreneurship in Boston College’s newly opened Integrated Sciences Building. Soward, clad in jeans and a hooded sweatshirt—the unofficial uniform of those working in the world of tech—spoke of self-driving cars and how to get moving with any startup. Read about the event.

Global Ranking Keeps Carroll School in Good Company

02-24-2022

The school is 26th in the world for faculty research, according to The Financial Times.

.jpg)

To MBA or not to MBA?

02-03-2022

That is the question for many. Five first-year MBA students at the Carroll School talk about what led them to pursue full-time studies in the pandemic’s latter days—and why they chose Boston College.

Good Sports

02-03-2022

While known for their resounding success in Alumni Stadium and Conte Forum, these four Eagles have taken their athletic skills on the road, appearing in the NFL playoffs and the 2022 Beijing Winter Olympics.

Unglamored: Marketing Student’s Novel Sheds Light on Mental Health

12-14-2021

At the beginning of the pandemic, many students saw the months of quarantine ahead and wondered how to fill that time at home. Jessie Cheng ’23 saw an opportunity rather than an obstacle: She decided to use her newfound surplus of free time to write. The result is her recently published novel Unglamored, which is not just a passion project but also a means to start a conversation about mental health and eating disorders—important subjects the author thinks students at BC could benefit from discussing.

Our Zip Code, Our Fate

12-14-2021

At a time when the world’s attention is fixed on global challenges such as COVID and climate, two Carroll School centers have launched a conversation about something closer to home—what happens within a half-mile of where we live. Leaders from a pioneering national organization, Purpose Built Communities, spoke about reversing the fortunes of distressed urban communities at the annual Jane Jacobs Lecture presented by the Joseph E. Corcoran Center for Real Estate and Urban Action and the Winston Center for Leadership and Ethics.

Here Comes the Pitch

12-14-2021

“When can I buy one?” Jeremy Gall '96, CEO at Breezeway, inquired after Jack McConnell ’24 gave his 60-second pitch for Katch, an innovative package lockbox. With a chuckle, McConnell began to outline his product’s introduction to the market. His confident and professional pitch won him first prize and $600 at the annual Elevator Pitch Competition hosted by Start@Shea, the student executive board of the Edmund H. Shea Jr. Center of Entrepreneurship. McConnell was one of 10 student participants to advance to the final presentations.

Alum Embraces the Millennial Customer

12-09-2021

Katie Diasti ’19 knows the importance of relating to her audience. While still a marketing major in the Carroll School, she developed the business plan for what would become Viv for your V, her line of toxin-free and eco-friendly period care products. With help from accelerator programs like Accelerator@Shea and SSC Venture Partners, she has expanded Viv’s offerings. Now, Viv is drawing attention in the media and business world, partly because its customer base has grown five times since its 2020 launch.

Financial Literacy Research Award

12-01-2021

Assistant Professor Megan Hunter received the best paper award at the Georgetown Financial Literacy Excellence Center's 2021 Cherry Blossom Financial Education Institute. Formally, the award was the Financial Literacy Research Award for her paper, “Can Facing the Truth Improve Outcomes? Effects of Information in Consumer Finance.” This same paper is forthcoming at Marketing Science.

Irrational Persistence

12-01-2021

John and Linda Powers Family Dean Andy Boynton ’78, P’13 of the Carroll School of Management reflects on his leadership philosophy, life during the pandemic, and the many ways that the Carroll School and Boston College have—and have not—changed over the years.

A Hidden Dimension of CEO Compensation

11-10-2021

A new study co-authored by Mary Ellen Carter, professor of accounting at the Carroll School, may have an impact on how CEO compensation contracts are written—reducing the CEO’s incentive to manipulate earnings for personal gain.

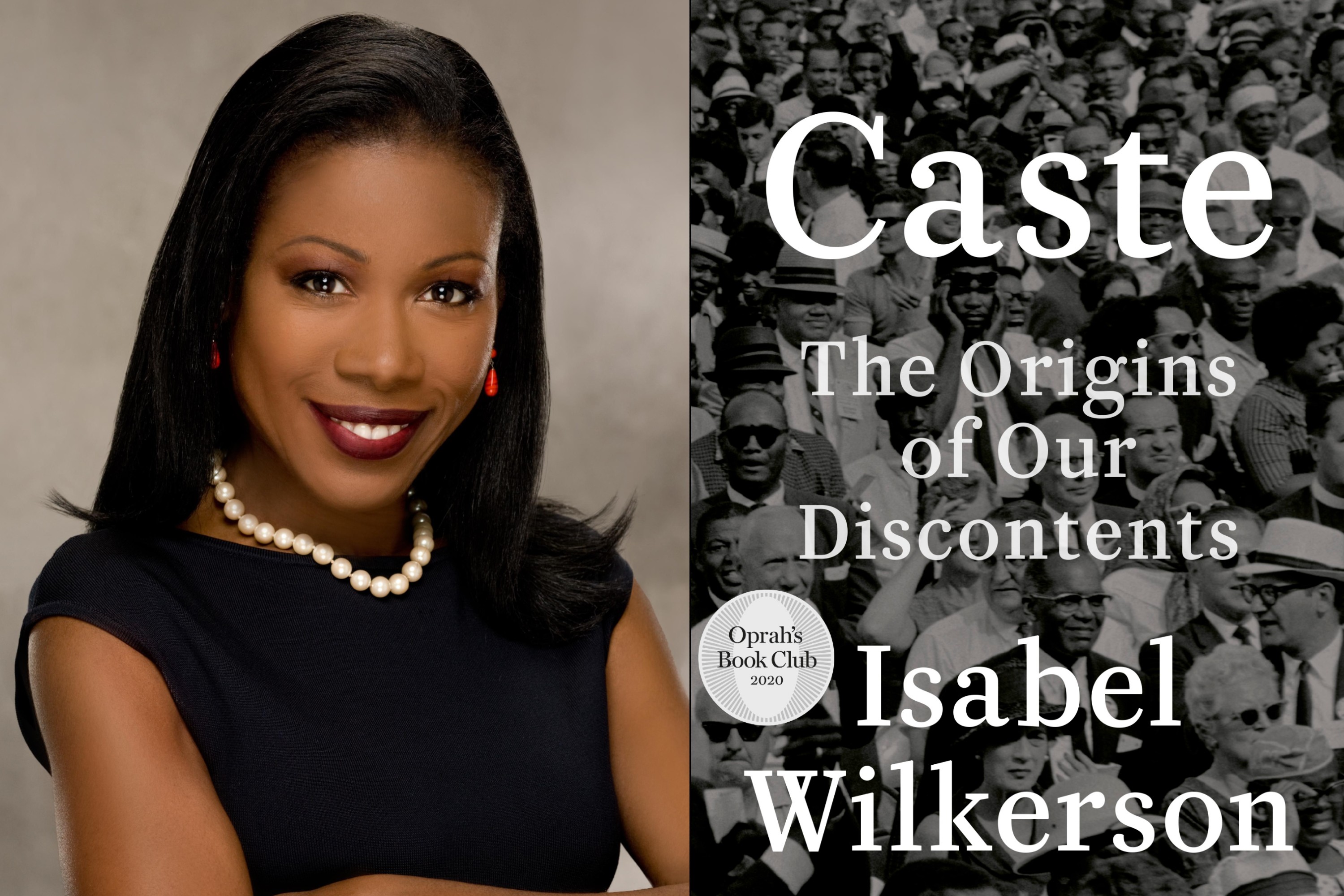

Does America have a “Pre-existing Condition”?

10-28-2021

At the start of the fall semester, Pulitzer Prize winning journalist and commentator Isabel Wilkerson engaged once again with the Boston College community. Ten years ago, she came to the Heights to lecture on her acclaimed book, The Warmth of Other Suns: The Epic Story of America’s Great Migration. On September 8, she was back (virtually) to speak with over 600 attendees about her recent book, Caste: The Origins of Our Discontents. Read about her lecture, in which she compared America to a medical patient with a “pre-existing condition.”

Sunlight Is the Best Disinfectant

10-27-2021

The Securities and Exchange Commission and shareholders of public companies alike have both been helped by a 2004 policy shift that allowed the sun to shine on the agency’s previously private comment letters to companies, according to a new study by Carroll School of Management Professors Amy Hutton and Susan Shu (Accounting), along with Xin Zheng of the University of British Columbia. The researchers find that greater SEC transparency has led to better enforcement and worthier shareholder suits.

MLB is Calling

10-05-2021

Boston College baseball is losing a star, but professional baseball is gaining one. Sal Frelick was drafted by the Milwaukee Brewers as the 15th overall pick in the first round of the 2021 Major League Baseball draft, and signed with them this past summer.

Journal of Marketing Editorial Appointment

10-01-2021

Associate Professor Gergana Nenkov accepted an invitation to be Area Editor at Journal of Marketing Research. In addition to indicating broad recognition in the field, her appointment continues a great tradition of editorial service both personally and across the Marketing Department.

Strong Results for Carroll School in Latest U.S. News Rankings

09-21-2021

In the latest survey from U.S. News & World Report, the Boston College Carroll School of Management has continued to stand among the nation’s most highly ranked business schools—with three departments in the top 20 and other programs on the rise.